The big news this afternoon is the Fed’s well-telegraphed rate hike, its 11th straight hike since it began raising the target Fed Funds rate in March 2022. But if bank treasurers were hoping for some sign from the Fed that there is a light at the end of the tunnel with these hikes, they are likely disappointed. The problem is that no one really knows where the Fed is headed, probably not even the Fed. Usually the next move after a pause is a cut, but apparently after today’s hike, that is not a rule. Today is a world of chaos and uncertainty, where you predict anything at your professional peril.

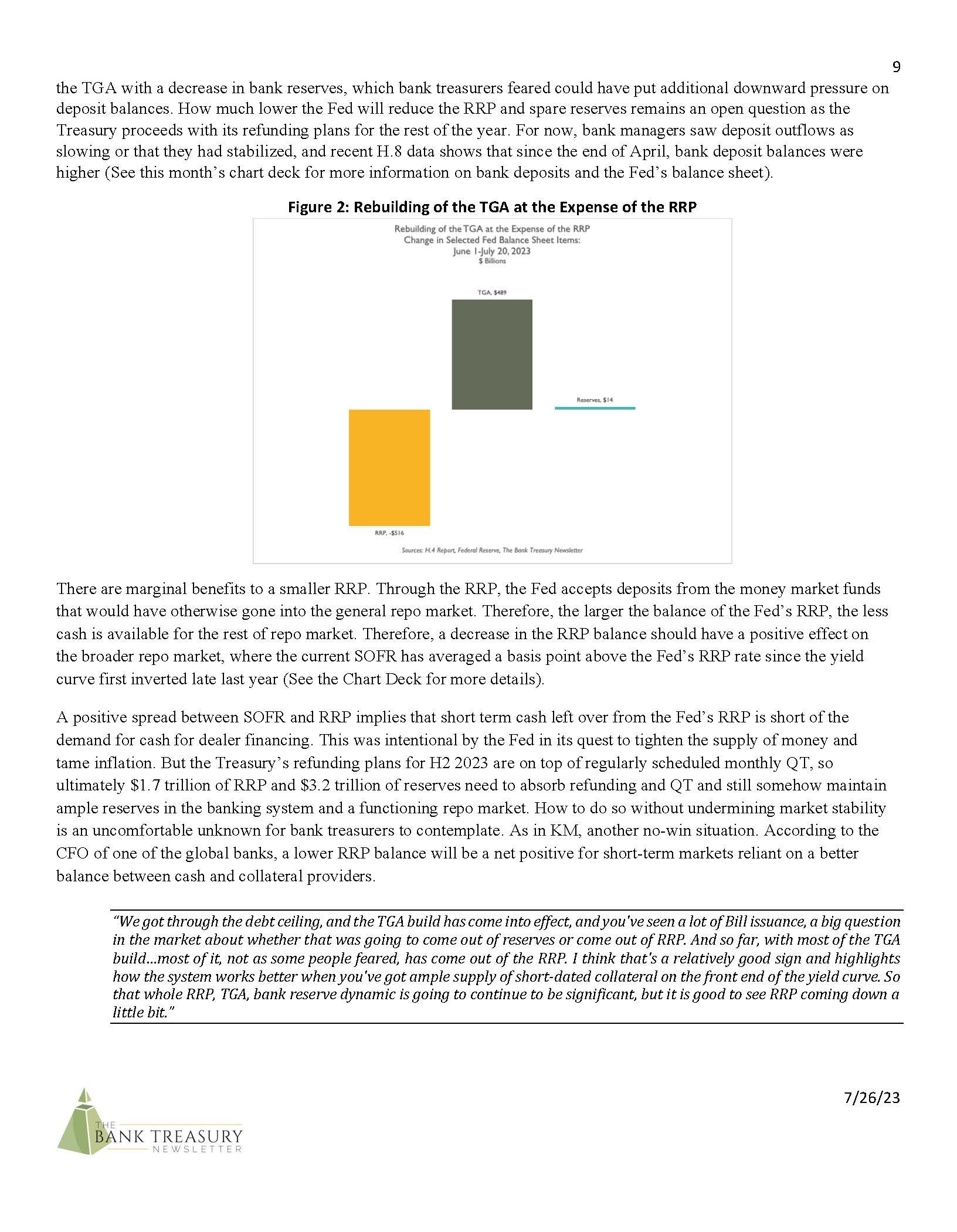

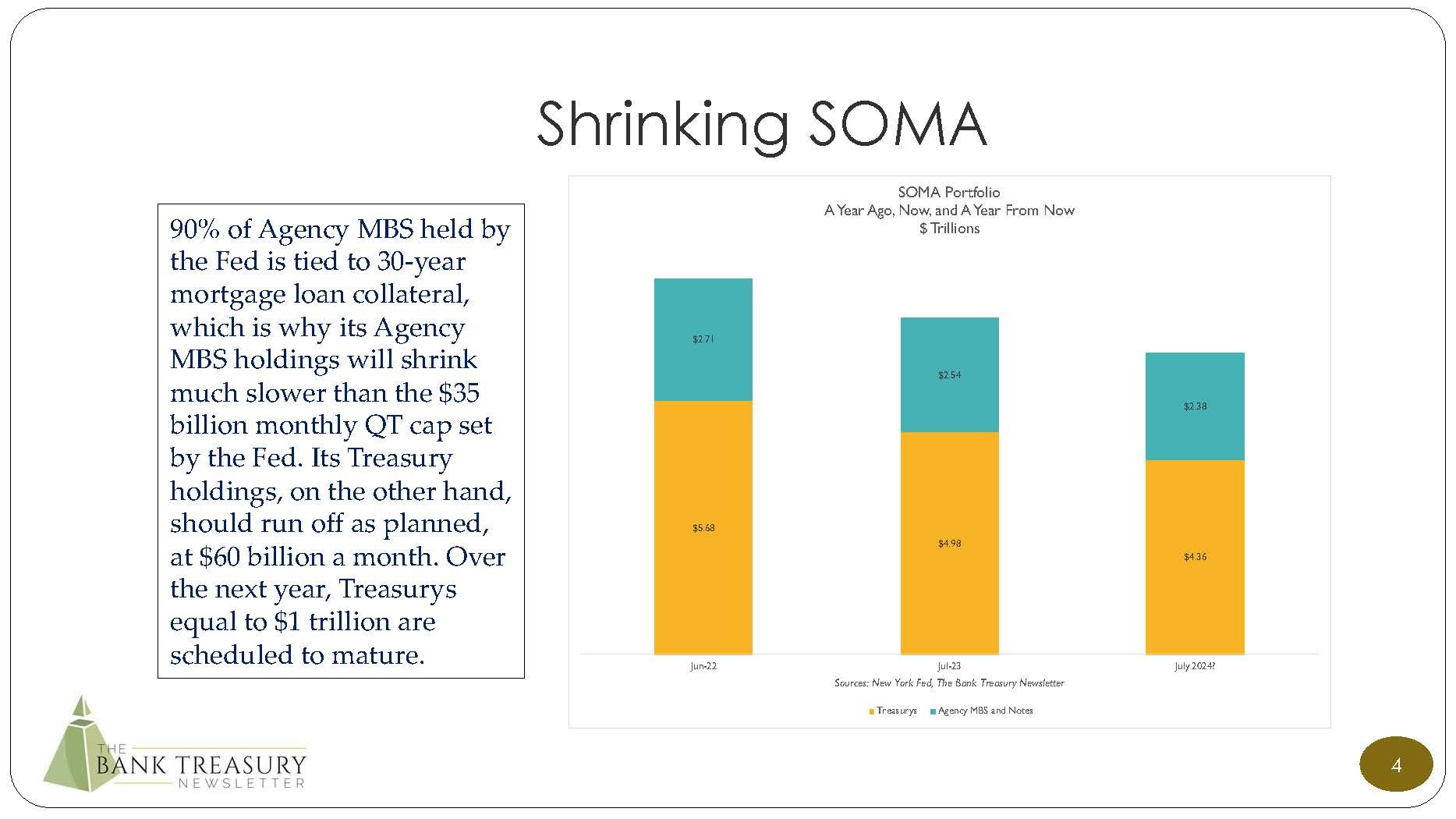

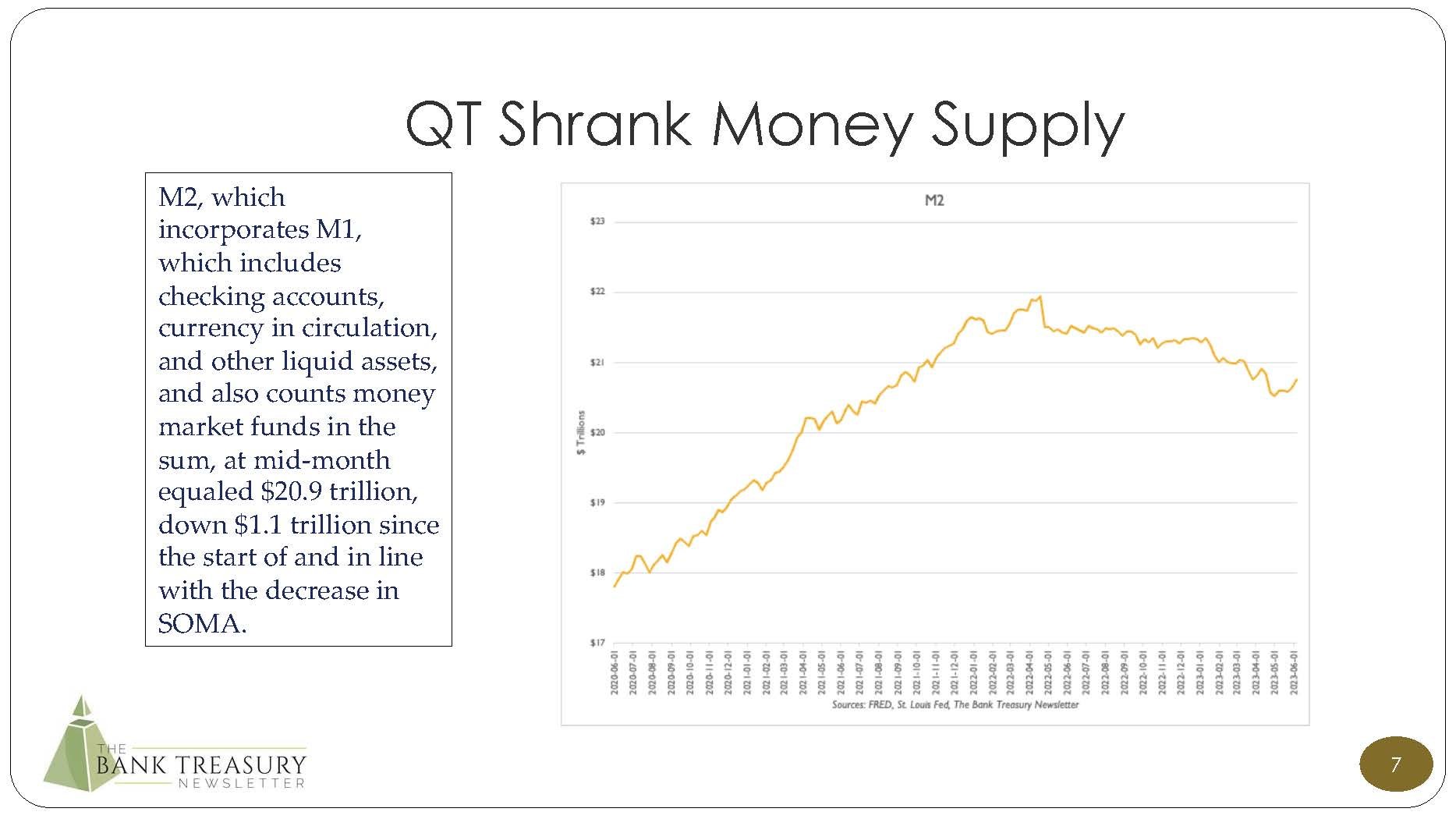

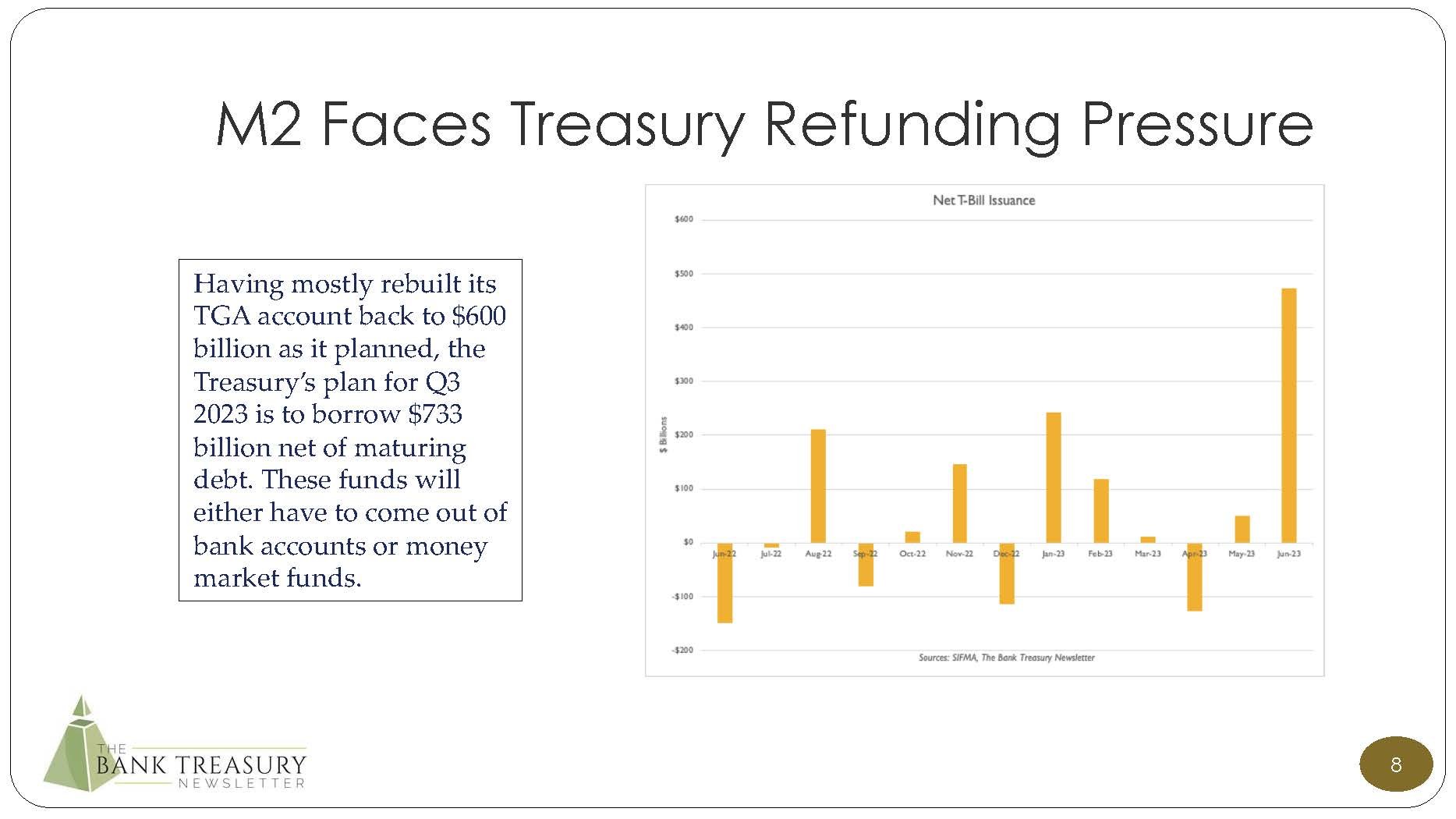

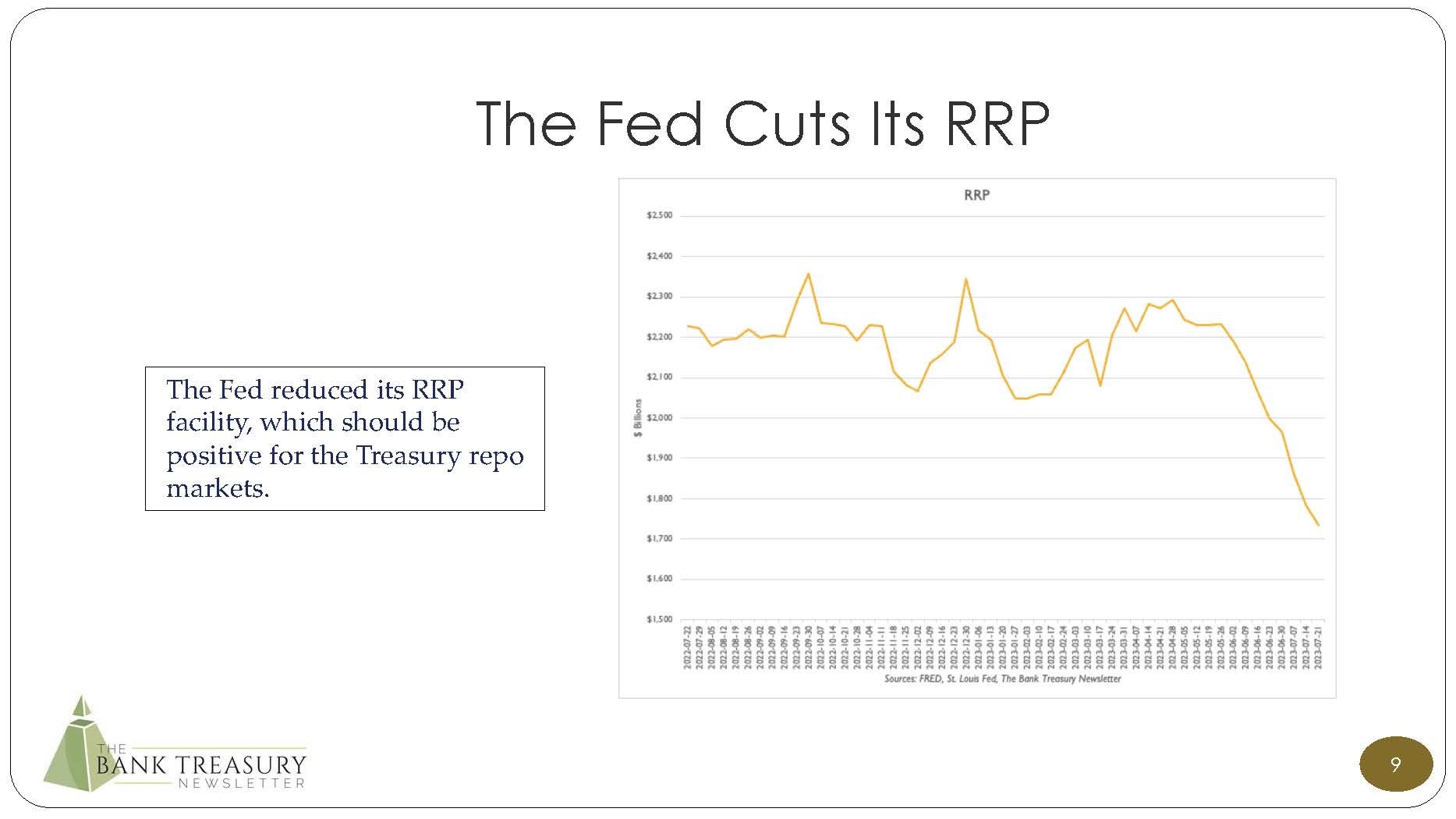

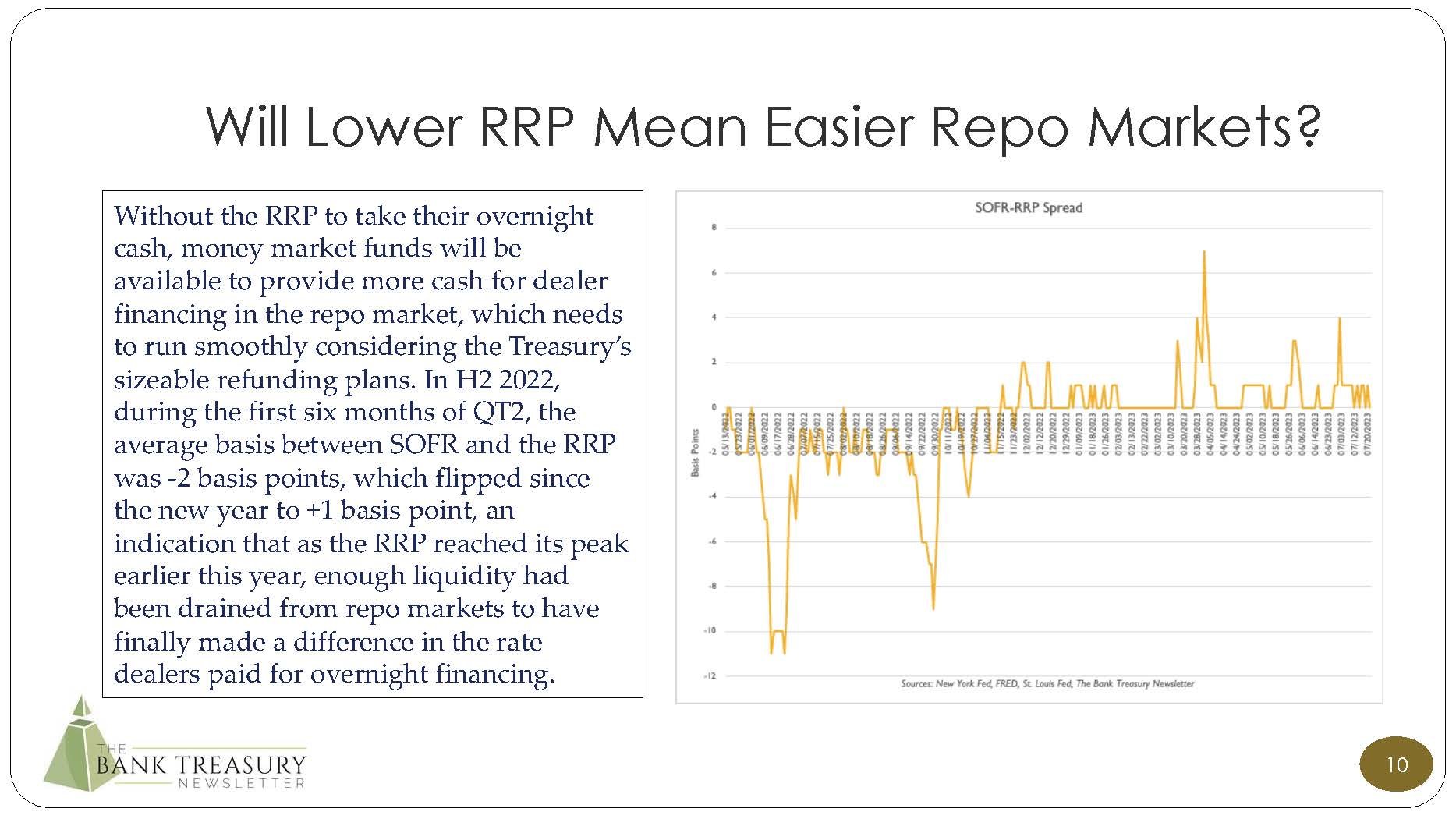

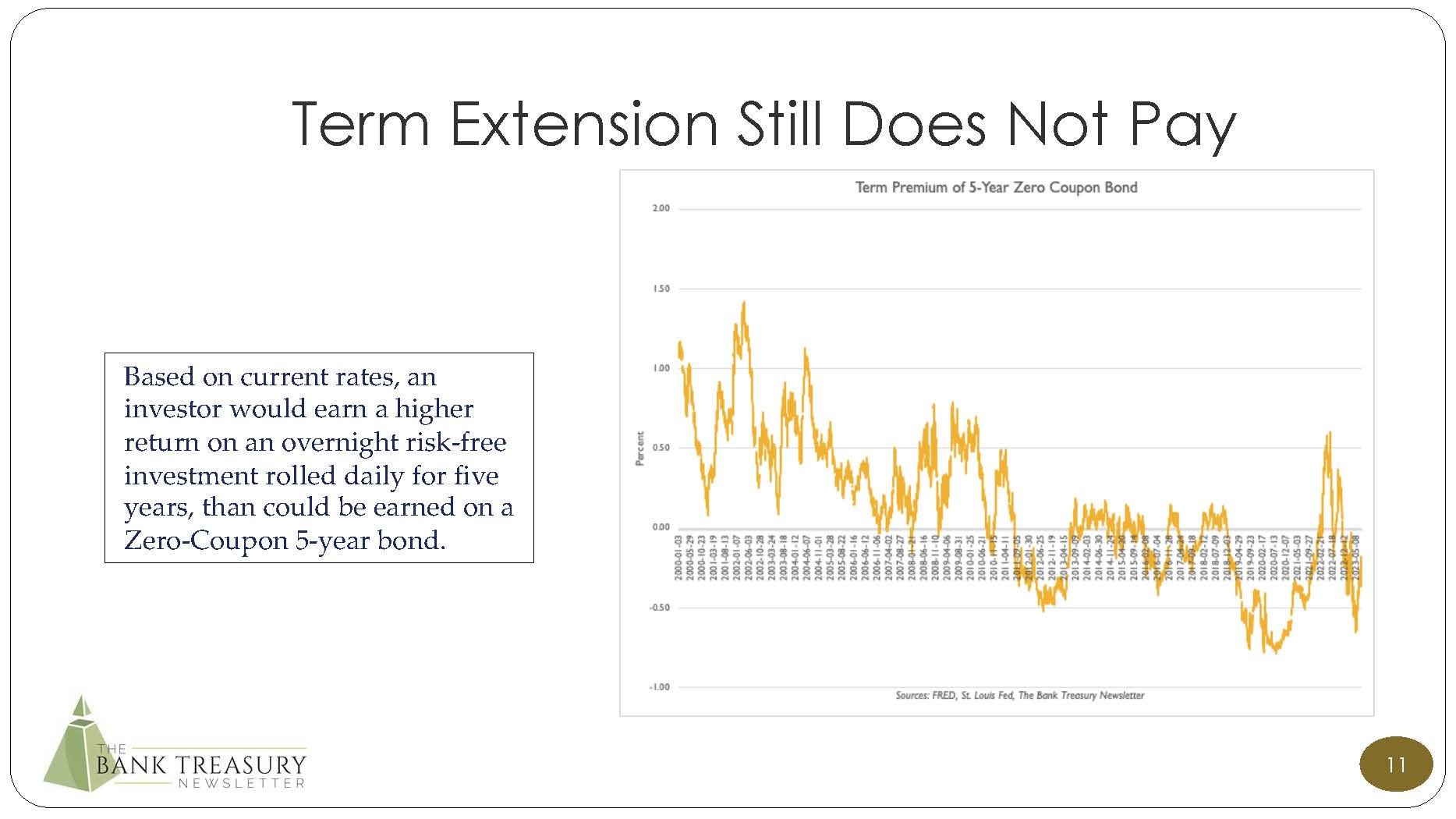

So, as this month’s newsletter discusses, bank treasurers are content to play it safe, to sit on cash that after today pays 5.4% overnight, content to wait for a clearer direction in the market. Besides, with the Fed still committed to shrinking its balance sheet and with more than $1 trillion of net issuance by the Treasury still to come in the second half of this year, there are good reasons for them to sit on cash. This is apart from the fact that with the yield curve so deeply inverted, there really is no better investment than a risk-free overnight rate.