BANK TREASURERS REMEMBER MARCIA STIGUM

Having hiked for the 11th time, bank treasurers I speak to are divided on the Fed’s next move. Will there be one more hike this year? Is the Fed done? Or just pausing? How about a cut in the next 12 months? Higher for longer? Honestly, if the roller coaster that the rates markets have been on really going back to the Global Financial Crisis has taught bank treasurers anything, it’s that predicting rates is forever humbling.

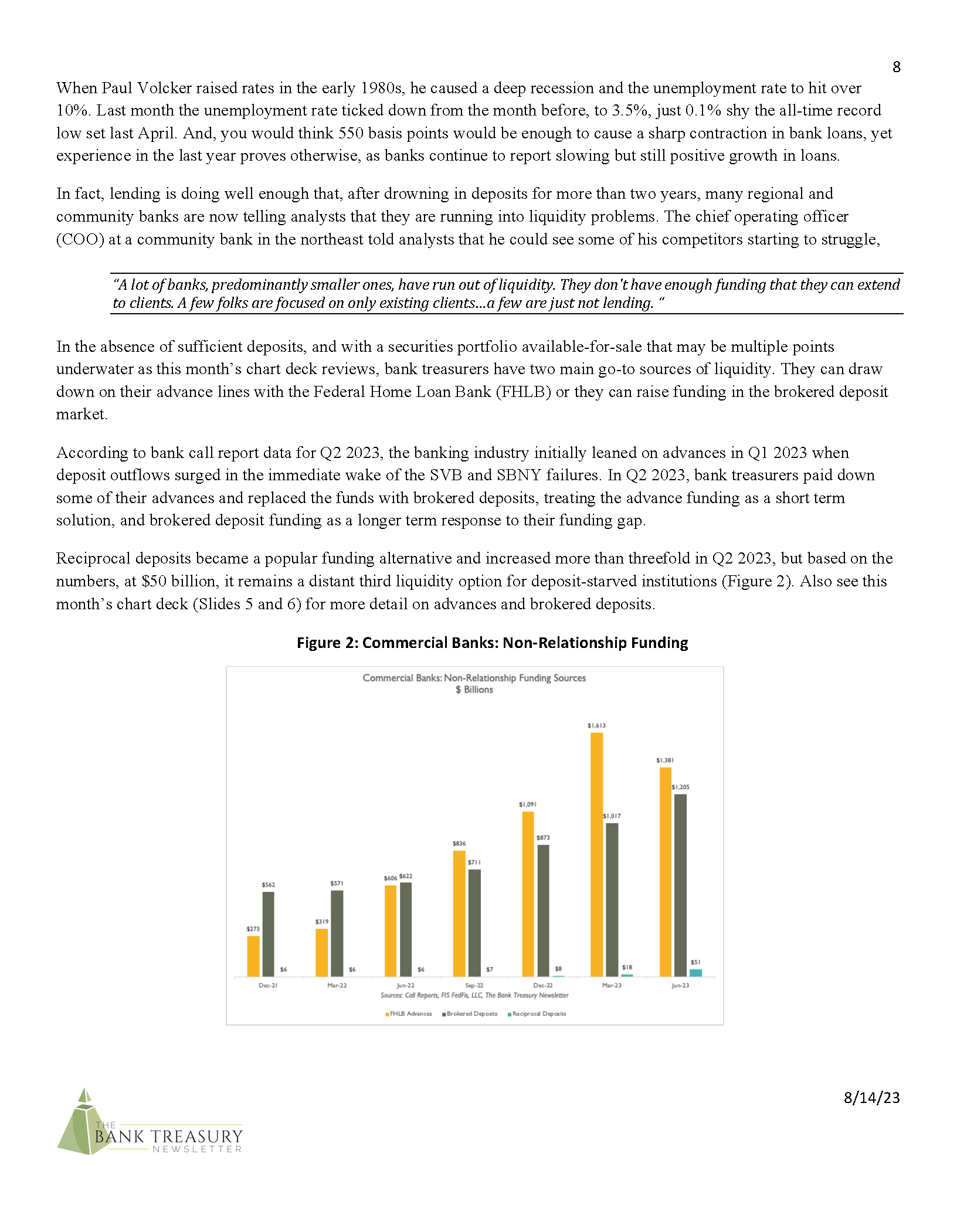

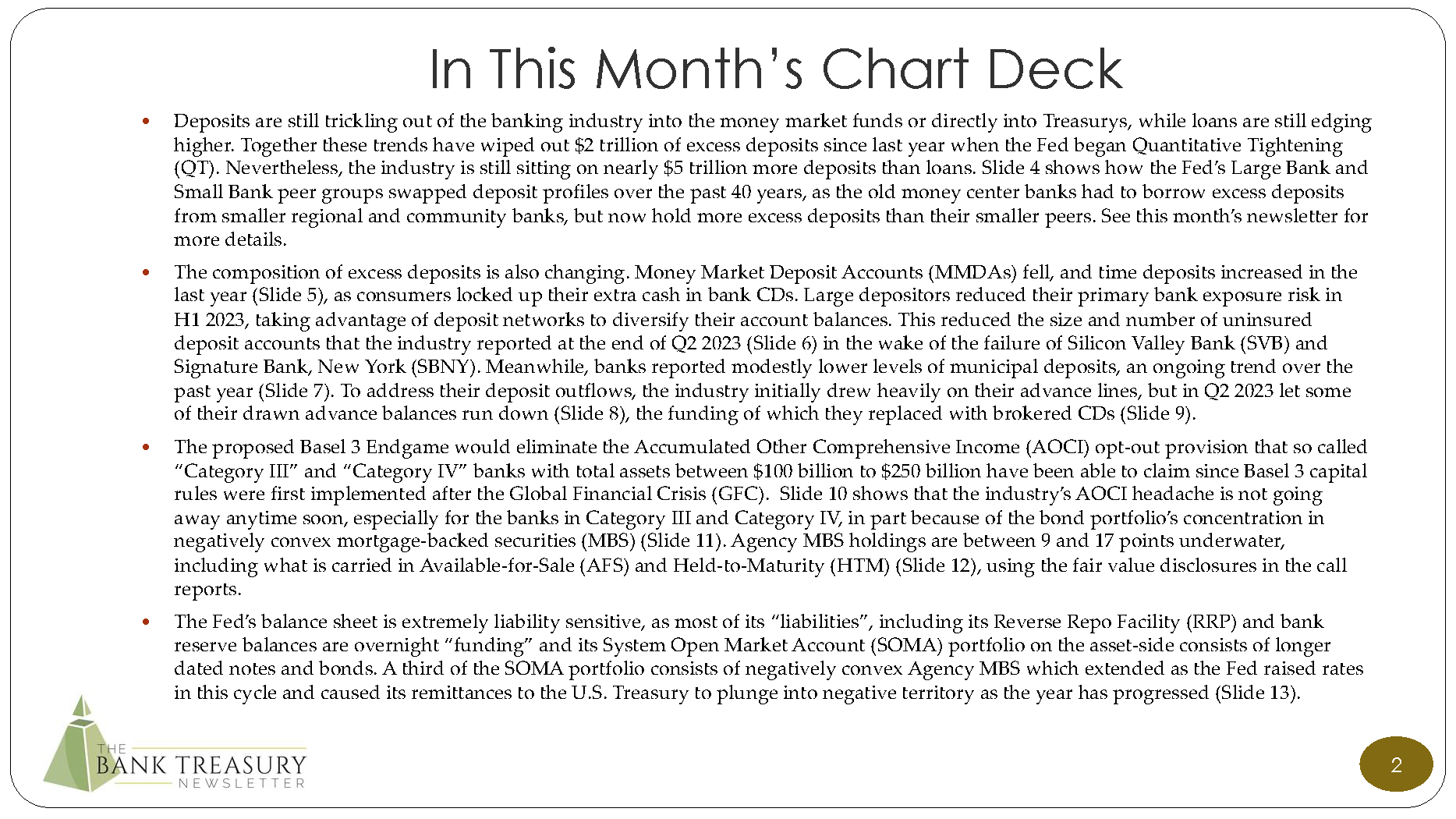

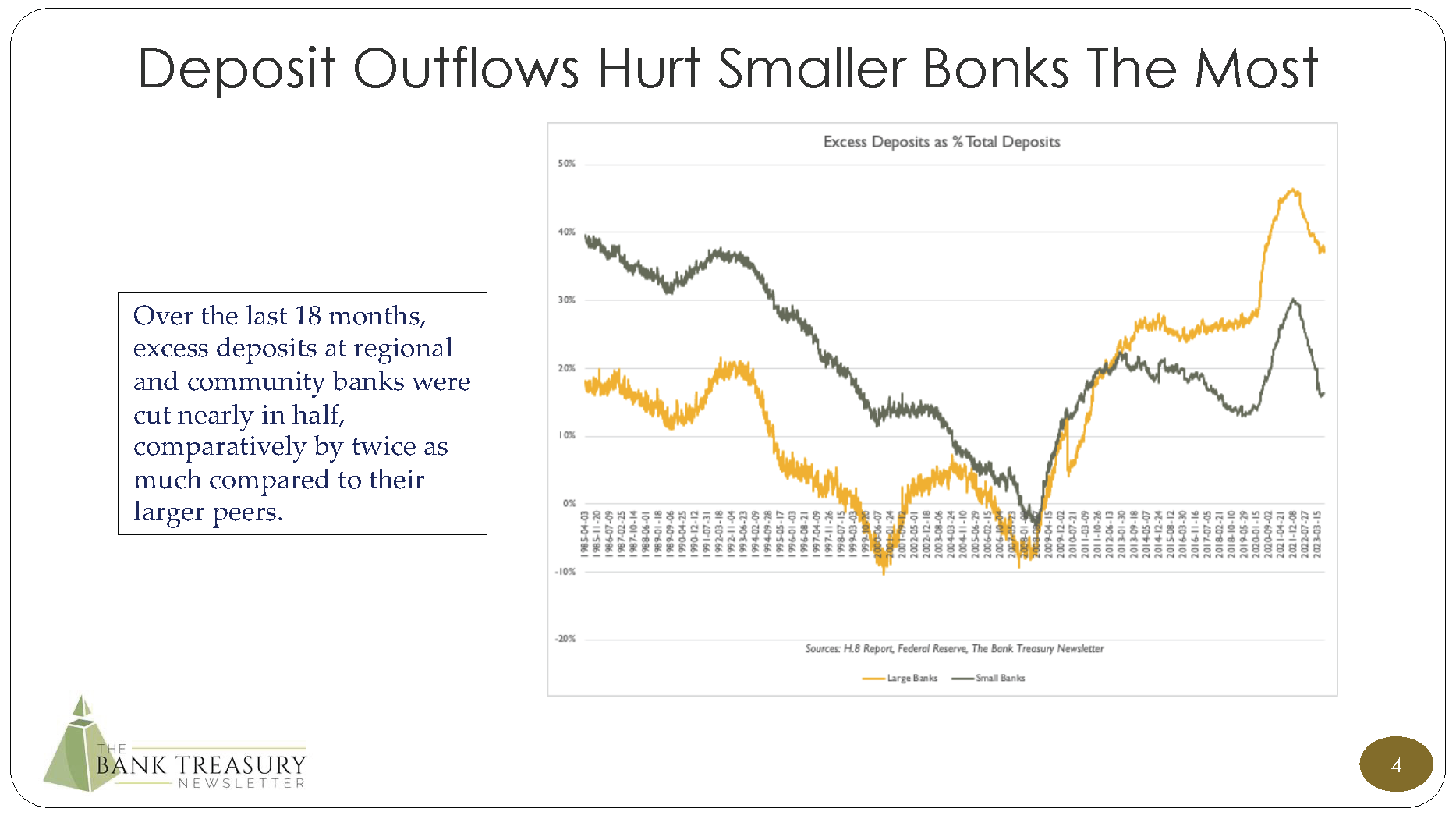

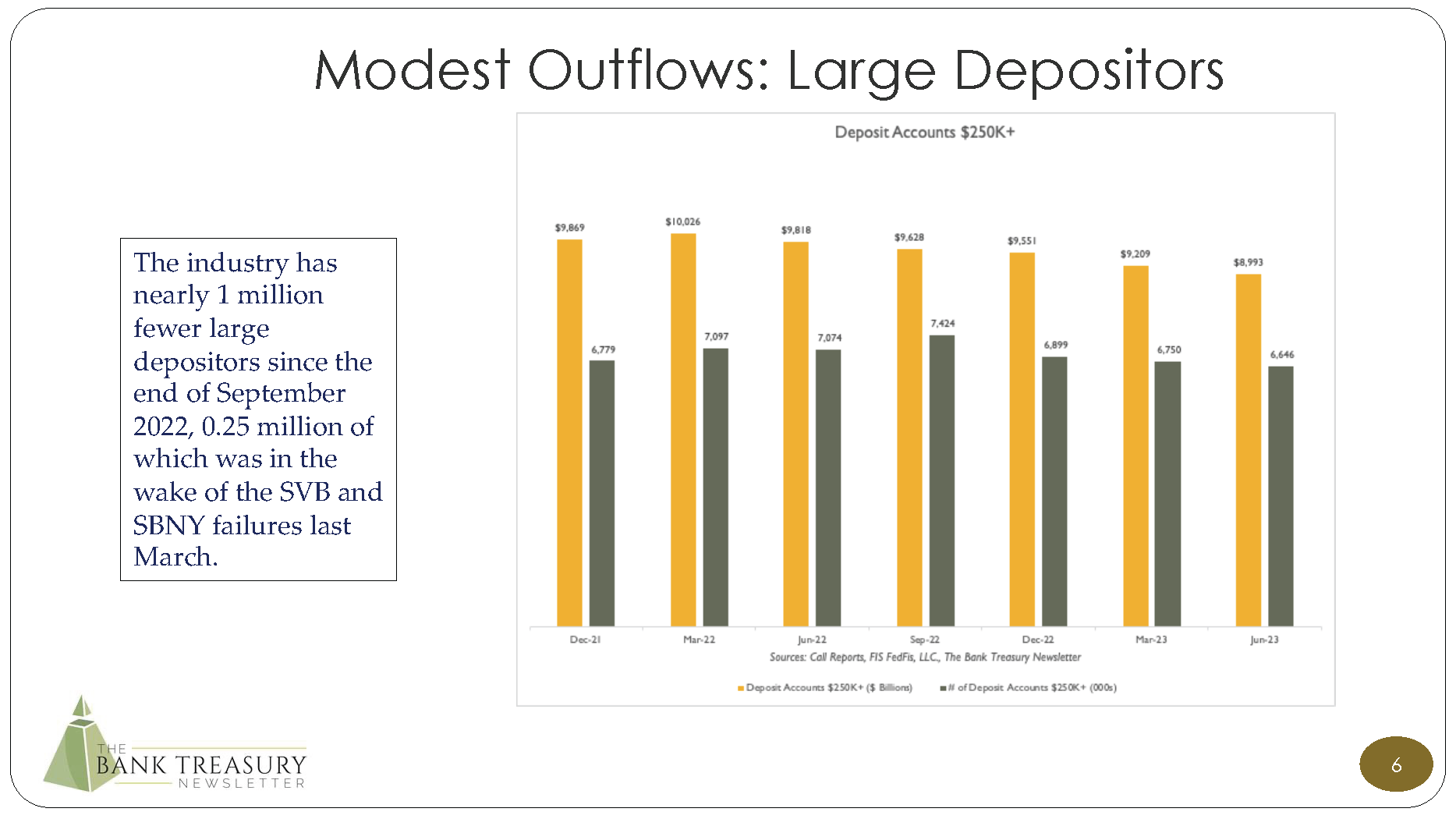

Bank treasurers, however, do not have a lot of time to worry about rates or buying bonds right now, or much extra cash to buy them with, halfway through the third quarter, with their deposits still leaking out to the money market funds and into the Treasury’s post-debt ceiling refinancing auctions, or getting bid away to a competitor. Added to that, loan growth is slowing down but is not negative and is still adding to funding pressures. So, trends with deposits and loans are shrinking their excess deposit piles. Plus, a flatter 3-month-5-year Treasury curve this morning is still 110 basis points inverted, which means the best investment is parking cash overnight at the Fed. You are paid to do nothing.

At first glance, the Fed’s latest battle against inflation, which appears to be succeeding, seems reminiscent of the Fed’s inflation battles in the 1970s and early 1980s, when Paul Volcker raised the Fed Fund’s rate to 21%. But unlike then, the economy is not deep in recession right now. Experienced economists must be hard pressed to recall another cycle where the Fed brought down inflation by taking the Fed Funds rate up by 550 basis points in 16 months, without wrecking the economy. It never happened. Considering the magnitude of what Jay Powell’s Fed did in this cycle, Paul Volcker’s rate hikes 40 years ago seem tame by comparison.

This month’s newsletter recalls Marcia Stigum’s 1983 textbook, “The Money Markets”, which was “the” book to own on one’s bookshelf if one were working in a bank treasury office in the 1980s. (Not clear how many people actually read it.) In any case, she was very famous back then but today, her book is outdated and almost no one in the bank treasury world or greater financial markets ever heard of her. She wrote the book when the money market world was ruled by the Eurodollar market, which ceased to exist with the end of LIBOR.

But some of her observations ring as true today as then, especially as concerns bank bond portfolios, as bank treasurers contend with negative AOCI. When I started the newsletter 19 years ago, bank treasurers told me then and would say today that the bond portfolio first and foremost is a source of liquidity. After that it is a source of income and is a hedge for the balance sheet. But, as she wrote, the time-honored bank treasury strategy of managing an investment portfolio as a source of liquidity ultimately destroys shareholder value. This is something to think about after SVB’s failure.

“What banks found was that as loan demand slackened, interest rates would fall sharply, and as loan demand picked up, they would rise sharply. In this environment, using bonds as a source of liquidity meant buying bonds at high prices and selling them at low prices. Thus, a bank that viewed its bond portfolio as a source of liquidity found the latter to be an automatic money loser, over times the portfolio provided some interest income, and a lot of capital losses.”

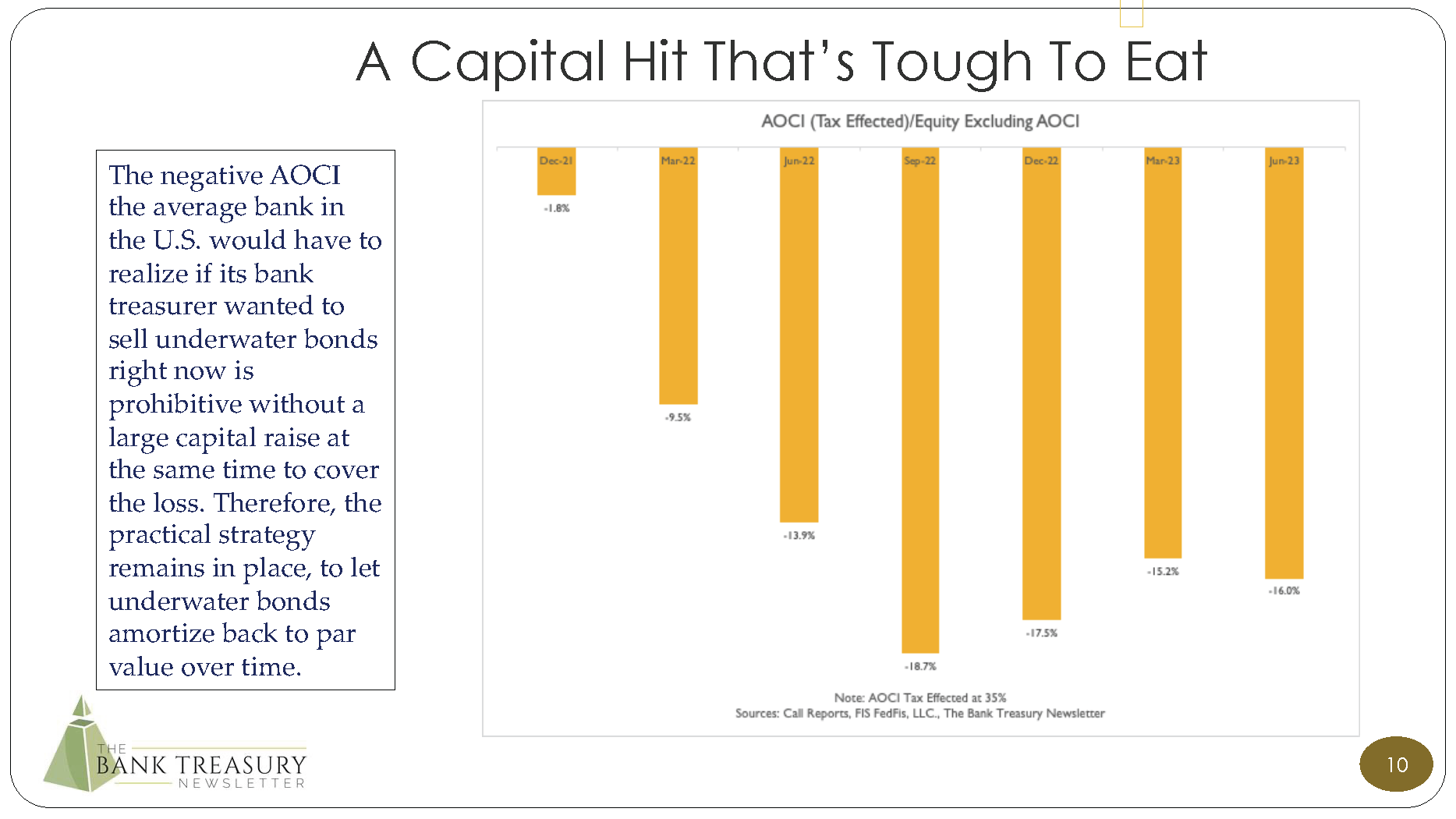

The cost of an underwater bond portfolio is set to grow for banks in the regulatory-defined Category III and Category IV groups, with assets between $100 billion and $250 billion, assuming the Basel III Endgame proposal passes as proposed and these banks need to capitalize AOCI. However, with a proposed 2025 start date and with a three-year transition, it seems hard to get very worked up today about a problem (given all the other problems one has) that could easily go away by then when (and if?) the Fed starts cutting.

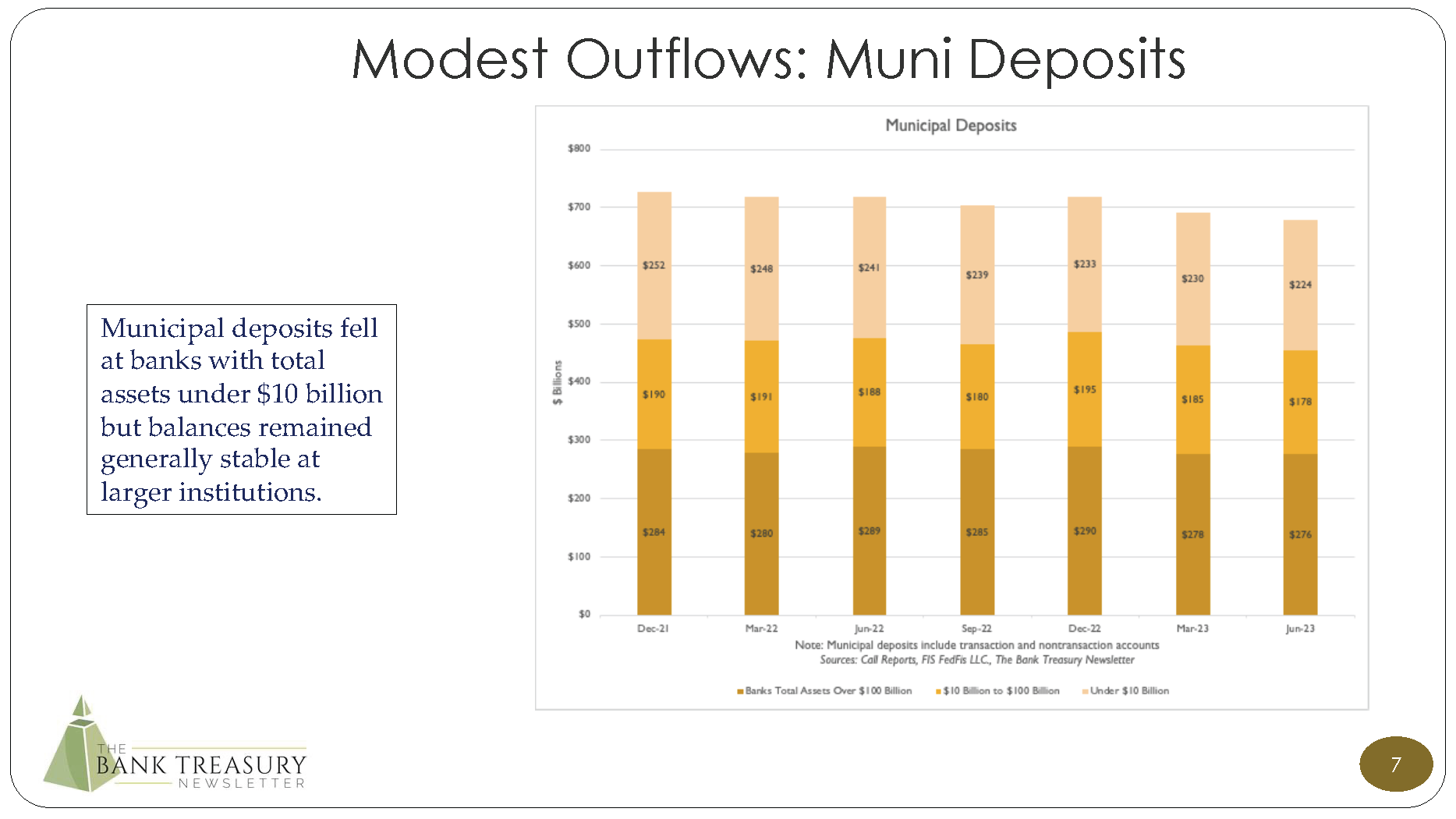

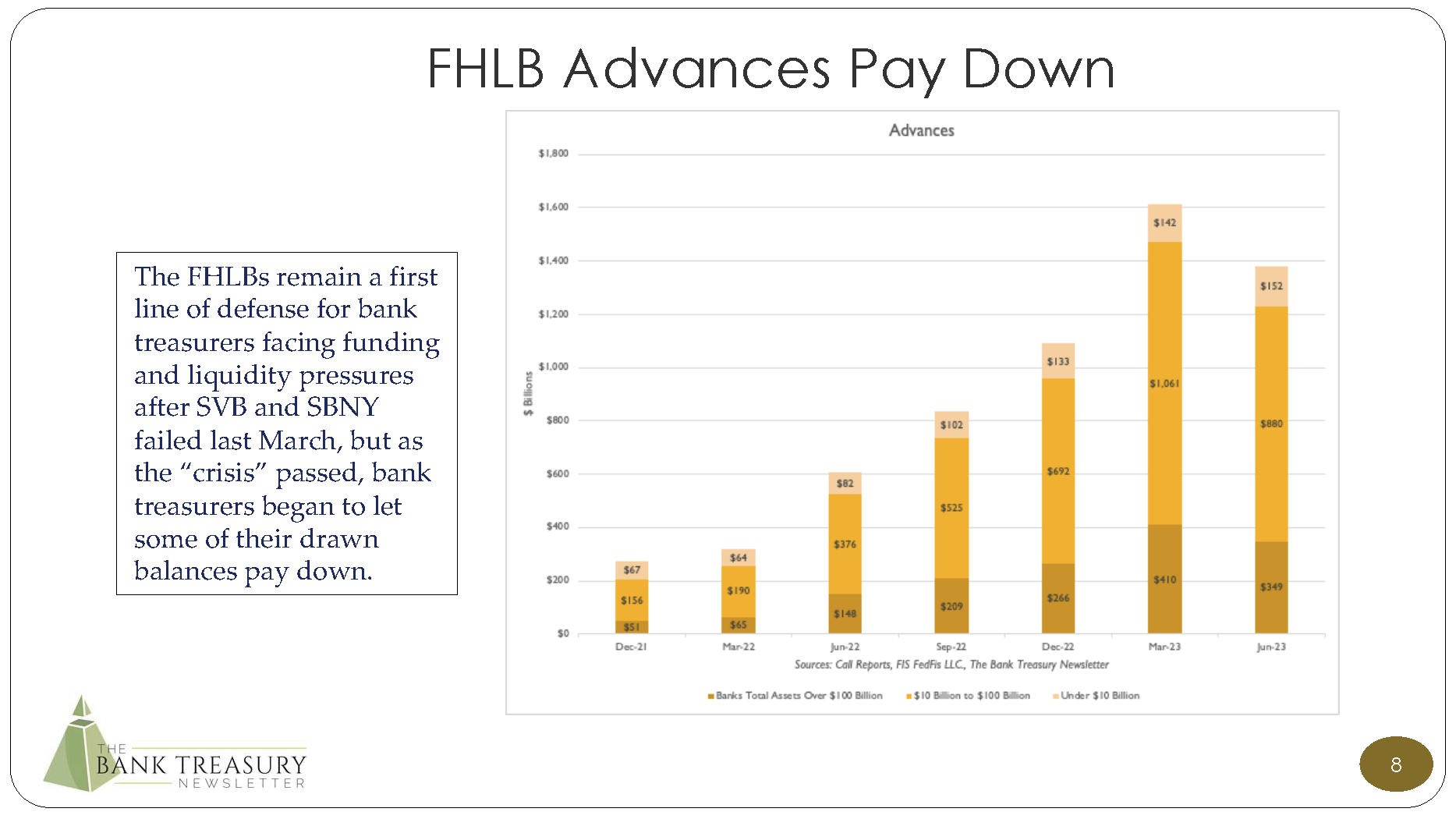

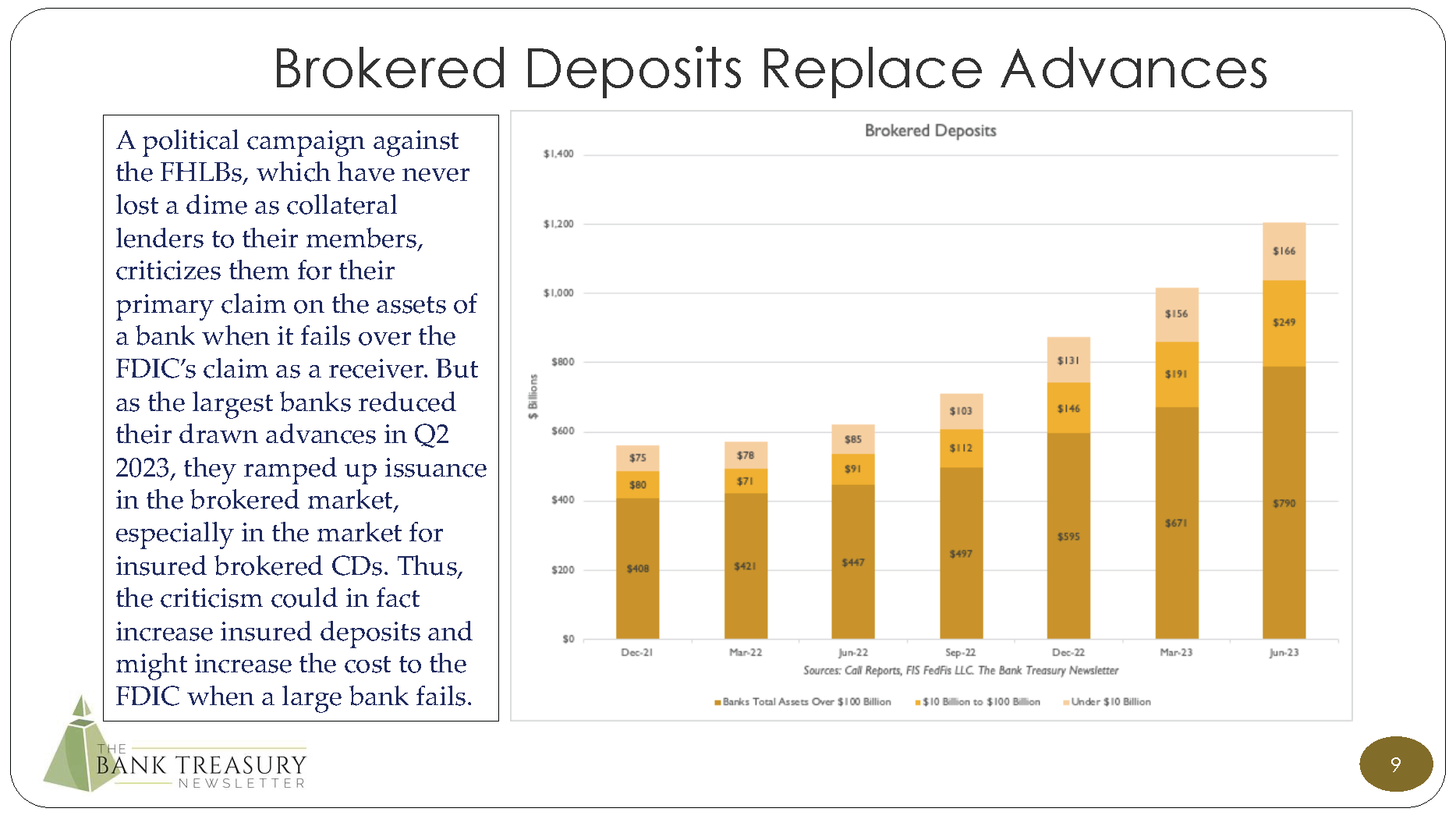

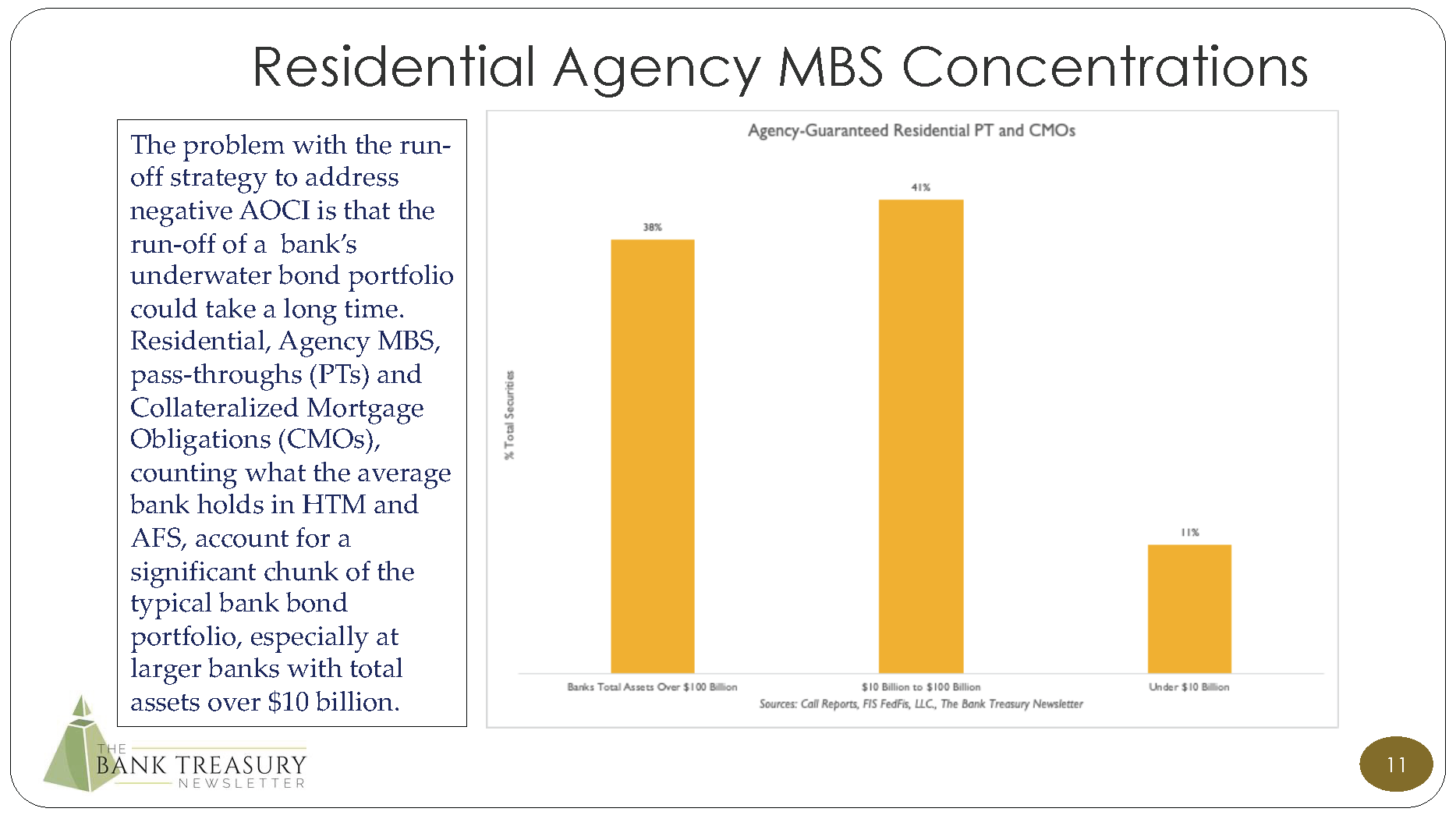

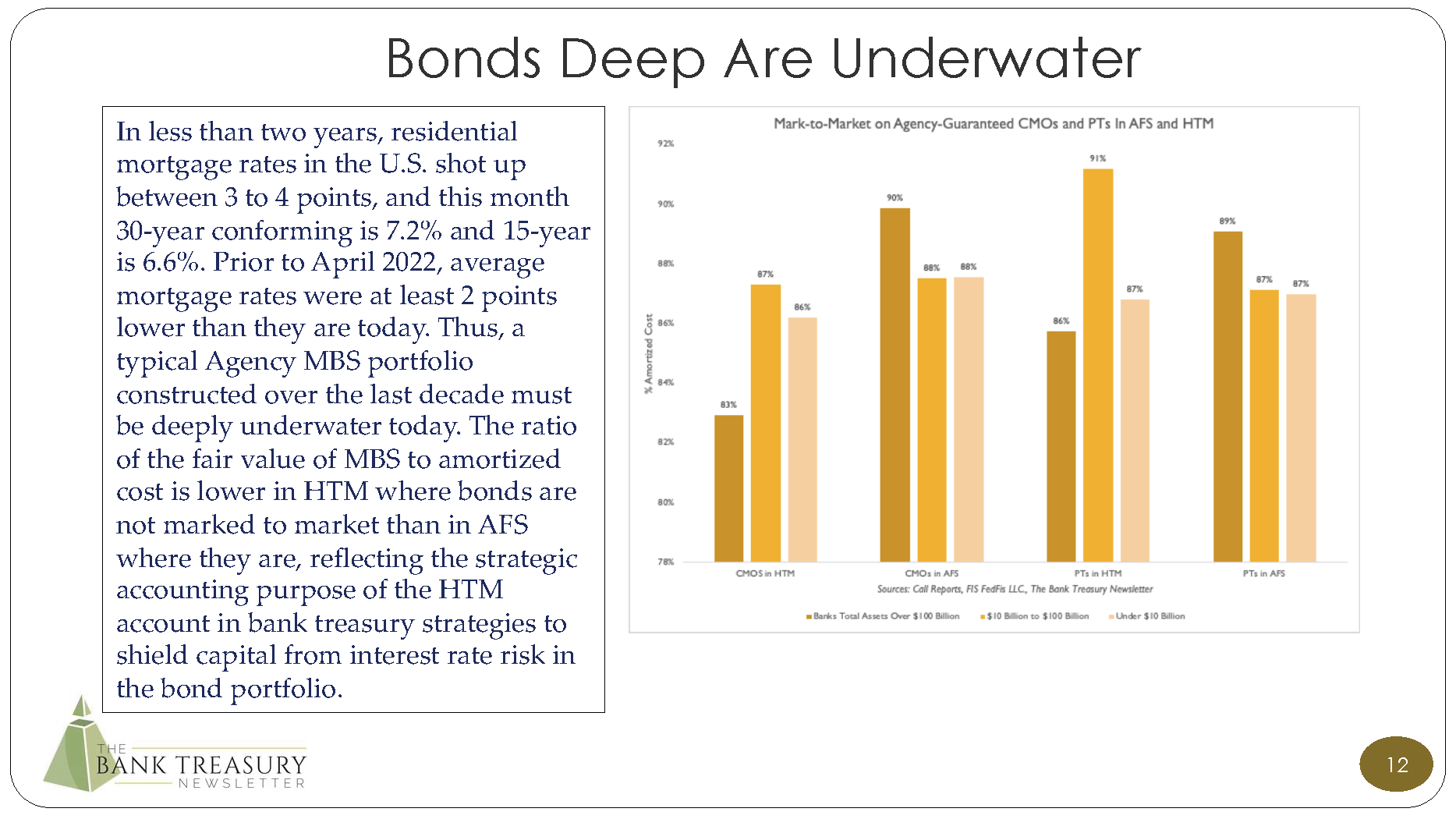

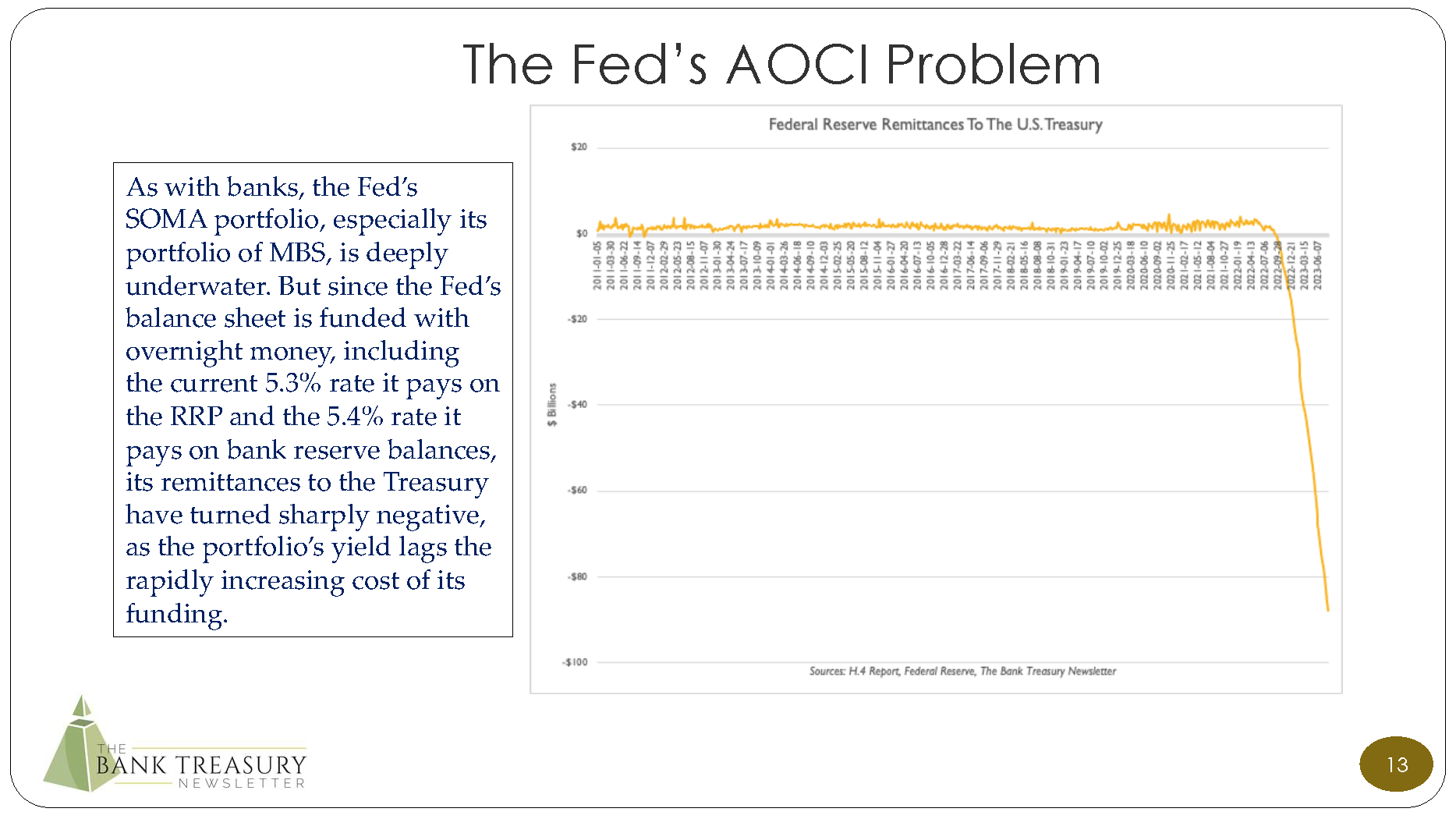

The first half of this month’s chart deck looks at deposit trends, how bank treasurers are using brokered CDs and FHLB advances to meet funding needs, and where recent trends might be headed. The second half delves into AOCI and examines the negative valuation marks on MBS in bank portfolios, which at the end of Q2 were anywhere between 9 and 17 points underwater based on call report disclosures. The most thought-provoking slide in the deck is the last one, which shows Treasury remittances by the Fed plunging deep into record negative territory this year, as the income earned on its own underwater SOMA portfolio lags the rapid hikes on the RRP and bank reserves that fund it.