BANK TREASURERS DON’T PANIC

Listen to an audio version of this newsletter on Apple Podcasts, Spotify, Amazon Music, Audible, or your favorite podcast platform.

The banking industry reported another solid quarter of earnings, which met and, in some respects, exceeded analyst estimates. Storm clouds on the horizon remain muted. According to bank management, credit is performing generally in line with expectations, consumer credit is in some cases a little better, and they are confident that their expected credit loss in office commercial real estate (CRE) will be covered by the credit reserve they established under on Current Expected Credit Loss (CECL) accounting. CECL accounting means that the reserves reflect a life of loan estimate for credit loss, booked on Day 1 of funding. Office vacancy rates have sky-rocketed since Covid, have not stopped increasing, and are unlikely to reverse any time soon because of the enduring changes since the pandemic, such as work from home, which has put pressure on commercial property values in cities such as New York.

For the record, banks have been increasing their provisions for credit losses over the last two years since the Fed began to tighten interest rates. According to the data from the Federal Deposit Insurance Corporation (FDIC) data, from Q1 2022 to Q1 2024, provision for credit loss for all commercial banks increased from 2% of the sum of net interest income (NII) and noninterest income to 8% in Q1 2024, reflecting a more than a fourfold increase in credit expense. However, it is equally valid that credit expense has been stable since Q1 2023, which echoes management’s central message that credit is stable.

Bank treasurers continue to hold off from trades that would reduce their asset sensitivity but remain concerned about protecting net interest income should the Fed cut interest rates sooner and by more than expected. According to the Fed’s H.8 data, since January of this year, in the absence of deposit growth, all commercial banks reduced their balance of cash assets by $0.3 trillion, to $3.4 trillion and used two-thirds of the cash to fund loan growth, and the balance to increase securities, the latter which equaled $5.2 trillion this month, equal to the balance held 12 months ago.

The Federal Open Market Committee will meet this month on the 30th and 31st, and the market does not expect it to change its target range for the Fed funds rate. However, the CME FedWatch forecast increased the odds of a rate cut in September 2024 to 89% and a 50 basis point cut to 10%, a 100% increase in those probabilities since the beginning of the month. The higher chance of a rate cut in September reflects recent political events and the release of another set of mixed economic statistics, including modestly slower employment and a modest decline in the consumer price index, balanced by more robust retail sales.

Quantitative tightening (QT) continued this month under the Fed’s new Treasury cap of $25 billion a month, which cut the pace at which the balance of its System Open Market Account (SOMA) portfolio ran off. Treasurys, declining by an average of $56 billion per month, are now running off at $22 billion. Notably, as SOMA declines and the Fed continues to hold a floor for its Reverse Repo Facility at its present level, the now more modest drain on reserves from QT is partially offset by an increase in Negative Treasury remittances. Negative treasury remittances account for the difference between what the Fed earns on SOMA and what it pays banks and money market funds to park their overnight money. The negative balance on the liability side of the Fed’s balance sheet has been growing at a rate of $8 billion per month, which compares to the $40 billion that is now running off from SOMA every month, including Treasurys and Agency Mortgage-backed Securities (MBS).

Stress test results were published last month for 31 large banks that participated in this year’s 2024 test administered by the Fed. As expected, all 31 banks passed, even in a severely adverse economic scenario, where CRE value falls suddenly by 40%. Michael Barr, who has spearheaded the drive to finalize the proposed Basel 3 Endgame and raise capital requirements for large banks, described the published results as generally demonstrating that they are well-positioned for Armageddon, although not in so many words.

The test also included a funding stress scenario where they had to convert 20% of their noninterest-bearing liabilities into time deposits. At the same time, their interest income on mortgage holdings remained unchanged, which assumed that their mortgage origination slowed with rising rates and prepayments extended the average life of their mortgage assets. The scenarios demonstrated the industry’s capital resilience. Still, they relied on a combination of factors and key assumptions and are a reminder of the limitations of stress simulations in gauging a bank’s capital adequacy.

The Bank Treasury Newsletter July 2024

Dear Bank Treasury Subscribers,

The good news about the Fed’s 2024 stress test (drum roll, please) is that all the banks that took it passed even its worst-case scenario. Yay! The general outcome was never in doubt, regardless of the struggles some individual institutions may now face after the test to return as much capital to shareholders as they had initially planned this year.

Lacking the drama surrounding the first public stress test led by the Fed 15 years ago, the Supervisory Capital Assessment Program (SCAP), the test has evolved in form and consequence for the institutions subject to it into the annual ritual that it is today. As readers of this space remember, SCAP was a quantitative analysis of bank capital. It evolved into the Comprehensive Capital Analysis and Review (CCAR). Notably, CCAR included both quantitative and qualitative sections, unlike SCAP.

So, there was a buzz of anticipation when the Fed released the results of the CCAR because the banks that took it could pass the quantitative section but still get tripped up on the qualitative section. But after the Fed dropped the qualitative section in 2019, the stress test went back to becoming just a souped-up quantitative exercise that everyone passes, and these days, the release of the results barely keeps the public’s attention focused on it through one news cycle. However, annual rituals still serve a purpose, however dull and perfunctory they may seem.

On paper, the test proves that the largest banks can weather a storm of Category 5 hurricane proportions and keep on lending. Based on the test, the Fed has a framework to review and approve the capital return plans of the large banks. It is also good practice for bank supervisors to put the large banks that collectively constitute two-thirds of the industry measured by total assets through their paces to get their management teams to be constantly thinking about how to refine their risk management systems and capital planning so that their banks can go on passing these tests and return capital to shareholders.

The public dimension of the stress tests is also essential. SCAP marked a critical turning point in the Global Financial Crisis (GFC), helping to reassure a nervous and uncertain public that its financial system was solvent and on solid footing. Even if the public is not paying close attention, making the results public every year still tells it that bank supervisors remain vigilant to prevent the next crisis. Bank supervisors nonetheless know that these stress tests are no guarantee against the real thing. But that these tests still do not stop them as much as is hoped is no mark against their value.

While the real thing is never like the simulation, there is no gainsaying the validity of stress test results that quantitatively demonstrate the capital strength of the largest banks. The test is very stressful, at least on paper, so banks need to hold a lot of capital to pass it. As the Fed summarized, the stress test involves the economy falling off a cliff,

“This year's hypothetical scenario is broadly comparable to last year's scenario. It includes a severe global recession with a 40 percent decline in commercial real estate prices, a substantial increase in office vacancies, and a 36 percent decline in house prices. The unemployment rate rises nearly 6-1/2 percentage points to a peak of 10 percent, and economic output declines commensurately…The two funding stresses include a rapid repricing of deposits, combined with a more severe and less severe recession.”

What Stress Tests Don’t Test

Leaving aside all the great arguments in favor of the Fed’s annual stress, the problem with it is that it tests for the wrong thing. Or, at least, it does not test what keeps bank supervisors up at night because the risk to the financial system from an economic recession that leads to a fatally crippling loss at one large bank is not their biggest worry. One big bank going down is not the issue.

Yes, if it holds more capital, it may reduce its risk of failing from a significant capital hit. Undoubtedly, its failure would disrupt the financial system and have economic consequences because it has ties everywhere. And yes, more capital will economize the cost to resolve it by the Federal Deposit Insurance Corporation (FDIC), which, with a deposit insurance fund that it reported last month equaled $125 billion, supports an insured deposit base that equaled $10.7 trillion.

On the other hand, larger capital accounts do not immunize a bank against a run because when depositors run on a bank, it is usually not because they first spent time parsing through its reported capital accounts and came to the opinion that they needed to pull their money out of it right away after they finished their breakfast. Depositors run on a bank when they think it will run out of money. Their motive to run is not any more complicated than that, and they do not care whether it is supposed to be well-capitalized. Sure, recessions are bad, but shocks get depositors out of bed to be the first on the teller line when the bank opens in the morning, and they will not even wait to eat their breakfast.

Maybe the Fed should add another twist to the stress test for the risk that several large banks fail overnight or over the weekend. Perhaps the Fed should make every bank subject to the test face consequences beyond their control to prevent, so if even one bank of the 31 banks that took the Fed’s 2024 stress test had failed it, capital plans for every bank would have failed, too. Can one imagine the reaction the industry would have to that idea?

On an individual basis, however, leaving aside the focus on how much equity capital and High-Quality Liquid Assets (HQLA) a bank should hold to weather its financial stress tests, in a crisis, there is no substitution for sound management and comprehensive planning for disaster. Surviving any kind of crisis comes down to the skills, knowledge, and character of the people on the management team.

For example, bank treasurers at regional and community banks distinguished themselves last year during the regional bank crisis and proved they are worth every penny their CFOs pay them. For example, research from the New York Fed identified 22 banks, including Silicon Valley Bank (SVB), Signature Bank, New York (SBNY), and First Republic Bank (FRB), that went through runs last year, when five banks including those three and Silvergate Bank failed,

“We identify 22 run banks with significant negative net outflows on one of the days between March 9 and March 14, all with net liquidity outflows exceeding 5 standard deviations of their historical net outflows.”

From the analysis, the authors found that for the 19 banks that survived, their common denominator had nothing to do with using their securities portfolios as a source of liquidity. Their key conclusion was that,

“Counter to the assumptions underlying liquidity regulations, which implicitly offset runnable liabilities with liquid assets including securities, we show that banks with large net outflows shore up liquidity with new borrowing instead of asset sales…In contrast, we find no change in run banks’ securities holdings, suggesting that banks prefer to fund securities through borrowing funds at the prevailing rate rather than selling them at a loss. Banks then appear to actively seek additional deposits…at the cost of paying significantly higher interest rates on deposits.”

There is no formal stress test for bank treasurers to be put in a situation room during a simulated crisis to see how they and their contingency funding plans work. Indeed, there is no better stress test than the real thing. Regardless, the Fed’s stress test focuses on a bank’s accounting capital, not its human capital, which often matters more in an emergency.

Bank Supervisor’s Worst Nightmare

But what terrifies bank supervisors, their nightmare scenario, is not just a run against one bank, but one that mushrooms into a systemwide, full-blown bank run, otherwise known as a panic. Panics are their greatest nightmare because they are hard to see coming. Panics are not just about a run on one bank but on many banks simultaneously. A panic is a mad rush out of the exit signs from the financial system.

How great if there were a test for the financial system’s vulnerability to liquidity crises and panic attacks. Unfortunately, they defy a test like that because each one is different, and it is hard to explain what caused them. There are common denominators in every bank panic, but as Ben Bernanke, the former Fed chair said in 2013,

“Our continuing challenge is to make financial crises far less likely and, if they happen, far less costly. The task is complicated by the reality that every financial panic has its own unique features that depend on a particular historical context and the details of the institutional setting.”

Panics disrupt financial systems and bring lasting ruin to economies. Bank supervisors lose a lot of sleep over the possibility of panic because panic does not discriminate between good and bad banks. Even healthy banks with a lot of capital can struggle to survive them, and it is difficult to contain them when they break out because they prove so challenging to explain.

Of course, it may be easy to say that bank managers should have seen trouble brewing long before it blew up in their faces last year. Of course, in retrospect, you do not go long in 2021 on bonds paying 2% coupons at par, even though extending the duration in 2021 was the only way to pick up any yield to accrete for net interest income (NII). Of course, you do not hoover up nonagency Collateralized Mortgage Obligations (CMOs) just before the GFC. Of course, of course.

However, the financial system is very complex, and banks not only connect to other banks but also with shadow banks, the Fed’s balance sheet, institutional customers from various industries, and retail customers with varying degrees of financial sophistication. The web of complexity makes it challenging to see how point A connects to point B. Indeed, it breeds the conditions for panic. Vulnerabilities are not always visible to the naked eye because there are a lot of interconnected data points, and you need to know what to look for in a pattern to connect the dots and appreciate that not all connections connect with a straight line.

Credit information is asymmetric in this system, so some know about the current health of the bank where they deposit their money, some that only have the last quarterly report, and some that think they know all about the situation but are misinformed. Transactions between counterparties in this system ultimately come down to trust, which is famous for its disappearance at a moment’s notice. It just takes a spark to make a bubble burst.

Why Depositors Panic?

Bank supervisors are not even sure what causes panic or why the banking industry is vulnerable to them. Recessions sometimes precede panics, and the history of panics shows that vulnerabilities in the structure of the financial system lay in plain sight in retrospect. Over-leveraged balance sheets, poor underwriting, unstable funding, bad governance, and inadequate risk management are the hallmarks of an accident waiting to happen. But then there is a spark, some shock to the system, which causes the public to hoard cash.

Why do depositors suddenly withdraw all their funds from their bank accounts and hoard cash in their proverbial mattresses? One theory holds that random shocks to the system can lead to a bank panic. An announcement of bad news, such as the sudden outbreak of a major war, the onset of Covid, an adverse financial announcement with far-reaching repercussions, or a stock market crash, have caused them.

But a surprise does not have to be financial to cause them. Some economists at the Fed attributed panics to sunspots. Whatever the cause, people reach for their wallets, liquidity suddenly tightens, and then asset holders are forced into fire sales, which can cause losses that feed a panic.

The other theory for why depositors run is a sudden change in perception about the health of a bank or group of banks. It can happen like this. A hedge fund tries to corner the market on commodity XYZ, like maybe helium for balloons, but in the process, for whatever reason, perhaps it misjudged the cost, or the weather blew the wrong way, or whatever happened, it blew itself up instead. Now, hedge funds do business with banks, and when this hedge fund blows itself up, it goes down hard and leaves its counterparties exposed for a lot of money.

Never mind about the collateral arrangements, the credit ratings on the exposure, the guarantees, and all that, never mind, because it does not matter for the general uninsured depositor. They do not have access to that information to form any considered judgment on the size of the exposure. All they know is that Bank A, which holds their money, is in trouble because it did business with the hedge fund, and they could lose their savings. So, they run on the bank because uninsured depositors do not want to stick around to find out how the FDIC will treat their claims. Soon, nervous depositors descend on other banks that they either believe are also exposed to the hedge fund or have a similar profile as Bank A.

Part of the problem is transparency because banking is confidential, with only limited information publicly available. However, detailed line items in the call report go. Depositors, however, do not like to guess whether Bank A or B had exposure to the failed hedge fund because that is not public information; instead, they run on both banks with exposure to hedge funds—guilt by association. The Panic of 1907 started precisely this way. It exposed the vulnerability of a financial system that, up to that point, relied upon clearinghouses to rescue banks in the middle of a deposit run. Because of that, the Fed was born in December 1913.

And history does repeat itself. Thus, FTX, the crypto exchange, goes bankrupt, and shortly after, Silvergate Bank announces it will close. Technology and crypto industry executives who think they know but do not know the health of the banks where they deposit their money get spooked. On the same day as the Silvergate announcement, SVB decides it will restructure its bond portfolio and announces a capital raise, further freaking out its depositors, who then waste no time and run on the bank.

SBNY offered banking services to the crypto industry but did not have any direct credit exposure to crypto, which would mean losses for the bank were large enough to cause it to fail. FRC was in the mortgage industry and did business with high-net-worth customers. But when SVB failed, uninsured depositors were in no mood for distinctions and ran everywhere.

Office CRE could be the next source of panic. The subject is in the news as office vacancies and defaults grow. A report published this month by the Office of Financial Research flagged CRE as another level of risk for banks already weighed down by their underwater bond portfolios and digs as deep as it can through the public data to demonstrate the extent of the industry’s vulnerability to a credit shock, breaking down loan data by geography.

However, real estate assets are not just a matter of general location, east, west, north, and south. Real estate is location, location, location. CRE comes down to the property type, as the different outlook for credit exposures tied to new and old office buildings attests. However, the level of transparency in financial reporting does not go deep enough to help quantify those distinctions. So, depositors are left guessing and do not like it when they are kept guessing for too long. They may want out of there before something wrong pops up, a prominent real estate developer goes bust, or a few banks suddenly report mushrooming losses on CRE exposures that were not supposed to be a problem until they were. It might be too late to get their money out of the bank by then.

Understanding why a panic happens is the key to ending it. After the GFC, the public doubted the solvency of the banking system. SCAP specifically addressed the public’s concerns. But the crisis was not just driven by worries over bank solvency. During the GFC, the onset of Covid, and in March 2023, the normal functioning of the financial markets became impaired. Debt issuers found access to the capital markets was suddenly closed or severely constrained because cash providers held back from investing and risk-taking. The Fed had to convince them to come back to the market.

Thus, to restore confidence in the system and return the cash providers to the markets, the Fed flooded the financial system with liquidity through Quantitative Easing and worked with the FDIC and the Treasury to provide temporary liquidity guarantees on deposits and other emergency funding programs. It cut rates to 0% to restore market calm and kept them there until 2015. However, having great tools to address panics is insufficient because the Fed must know which tool to use and in what combination. There are three elements to containing a panic, as Ben Bernanke outlined, and knowing which one to use matters,

“Three basic tools for restoring confidence are temporary public or private guarantees, measures to strengthen financial institutions' balance sheets, and public disclosure of the conditions of financial firms.”

A Panic History Lesson

There have been plenty of bank panics in this country’s history to learn from. It seems as if the banking system is always in a panic. Economists have identified almost 20 over the past 200 years that were national in scale.

The first significant panic in the U.S. was in 1819. One could say it was an accident waiting to happen. Climate change played a role. Crops in Europe failed in 1816, which caused boom times in the ag industry and inflation as European countries used their gold and silver to pay for groceries. However, the crops recovered two years later, which was unsuitable for the U.S. ag sector. The U.S. textile sector was suddenly not faring so well, either. Great Britain, which had become a customer after the War of 1812 for its cotton and clothing mills, 1819 began to source cheaper material in Asia and other corners of the globe. Banks with exposure started to take on losses.

But the Louisiana Purchase was the match that lit up those depressing conditions and turned it into the panic it became. In 1819, it was time for the U.S. to pay France for what it owed. France demanded gold and silver, also known as hard money, which meant that paying off the debt drained hard cash from the economy that had driven an inflationary cycle up until then and began to cause deflation.

The Second Bank of the United States called in its loans to its customer banks to pay France, which meant that those banks had to call in their loans to their customers to raise the hard money they owed, which caused asset fire sales and massive losses across the banking industry. Soon, banks were failing left and right, and the country was in an economic depression until 1823.

Land prices collapsed. In New York, they fell by 20%. In Richmond, Virginia, they fell by half. In Pennsylvania, land values plunged from $150 an acre in 1815 to $35 in 1819. And then lots of banks failed. And it all seemed to happen overnight.

For every action, there is a reaction. The public learns lessons, their elected representatives pass legislation, and bank supervisors tighten regulations designed to fix the problem believed to have been the cause of the last panic. Then, there is another panic, but for different reasons than what caused the one that preceded it. Each panic is different, and the subsequent panic comes regardless of what Congress or bank supervisors did to fix the last one.

After the Panic of 1819, there were heated calls in Congress and state legislatures to do away with banks. Thomas Jefferson hated them even before then. He was against the chartering of the Second Bank of the U.S. and favored a policy restricting banks from lending more than the species held in their vaults.

He wanted to see banks completely deleveraged, the equivalent of telling banks today that they could only make loans backed 100% by equity instead of the 10-1 ratio that is the norm. He wanted them out of the banking business, which was then about turning a small pile of specie into the mountains of credit and overleverage that got the economy in the sorry state it had fallen. In 1816, even before the Panic of 1819, he wrote his friend John Taylor,

“I sincerely believe, with you, that banking establishments are more dangerous than standing armies…If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow…deprive the people of all property until their children wake up homeless on the continent their fathers conquered.”

However much the public blamed banks for their economic plight, there was no support to ban banks, as hard money was hard to come by, and bank credit was the next best thing. So, legislatures opted to regulate the industry, not ban it. They passed laws that limited new bank charters and others that penalized banks that refused to pay depositors in hard money.

But panics happen for many reasons. Overleverage and recession are not always their leading cause. After the Panic of 1819 came the Panic of 1837, for which a political clash between Congress and Andrew Jackson, and the failure to renew the charter of the Second Bank of the United States bears much of the blame. Reforms came again, and the establishment of clearing houses was supposed to help prevent runs or at least help prevent them from spreading. However, many clearinghouses improved the financial system’s resilience to panic, and more followed.

After the Panic of 1837 came the bank panics of 1839, 1857, 1873, 1884, 1890, 1893, 1896, 1907, 1930, and 1931. Many of these panics had something to do with a shortage of species. Depositors were forever worried about suspension, meaning the bank would refuse to repay them in hard money. Even the suggestion, a casual remark hinting that species was limited, would be enough to spark a stampede of demand withdrawal orders. If a bank did not have enough specie and could not convince the anxious depositor to take its note in place of specie, it would have to suspend deposit conversions, and if it could not recover, it would fail. As the public panicked and demanded their money back from banks, banks either suspended or failed.

Conversion and fear of suspension went together in the financial system, and fear of suspension is still a fear today among depositors, even with the Fed as the lender of last resort, deposit insurance, and the full faith and credit of the U.S. dollar. Indeed, the dollar used to be convertible into hard money, gold, or silver, and the Fed used to have a gold window where currency holders could exchange paper money for hard cash until Richard Nixon ended permanently suspended conversion in 1973.

Panics get started for many reasons. The Panic of 1857 happened because a large bank suddenly suspended conversion because of bad loans tied to the railroads, which caused the public to panic that the rest of the banks would suspend. It came against a backdrop of bankruptcies in the railroads. The panic in 1873 was also tied to railroads when Jay Cooke went bankrupt. However, seasonal demand by farmers for specie led to panics in 1884, 1893, and 1896. Copper triggered the Panic of 1907.

Panic-Prevention Reforms

There were more panics in 1930 and 1931 after the shock from the Great Crash had already subsided. By 1933, 9,000 banks had failed since 1930. The Fed might have prevented them had the 12 Fed banks not each had different ideas about their discount window’s availability to nonmembers. Consequently, their reluctance to save nonmember banks in their time of need worsened the situation. The panic and bank failures continued until Franklin Roosevelt closed all the banks for four days.

The next panic was 50 years later, a testament to how Glass-Steagall, the establishment of the FDIC, and reforms of the Fed had succeeded in preventing panics, or at least made them preventable. The match that lit the next crisis was when the Fed raised rates and inverted the yield curve, which caused the Savings and Loan crisis. Rate hikes contributed to a significant financial situation over the decade that grew into a nationwide commercial real estate crisis and a global debt crisis with lesser developed countries, but it did not subside until 1991.

In 1992, bank supervisors implemented the Basel 1 Capital reforms, and Congress passed the FDIC Improvement Act Reforms. But then came the GFC in 2008. Basel 3 capital reforms and the Dodd-Frank Wall Street Reform and Consumer Protection Act followed, which held back the next panic until last year’s regional bank crisis. The banking industry expects a final draft for the Basel 3 Endgame soon. However, Governors Michelle Bowman and Christopher Waller dissent at the Fed, and dissent on the FDIC board may push back that timeline.

Panics, reforms, panics, and reforms, one cycle after another. There is always another panic, and there is always room to raise capital and tighten regulations. But there is always another panic. Yet, the public’s insistence on learning lessons and doing something to prevent the next one remains unbowed. Bank regulation is an iterative process prompted by panics. As the economists Charles Calomiris and Gary Gorton wrote in their analysis of the origin of bank panics,

“…the history of U.S. banking regulation can be written largely as a history of government and private responses to banking panics.”

How can the public have confidence that supervisory responses to prevent the next crisis will be adequate if their responses to date have not prevented the next crisis? And it is difficult to fight the cynical suspicion that all the tighter capital and liquidity requirements bank supervisors are discussing have more to do with public relations than a conviction that the banking industry will be any better immunized from the next crisis with or without them. The Vice Chair for Supervision, Michael Barr, insisted last year that the Basel 3 Endgame was critical to prevent the next crisis,

“…the failures of SVB and other banks this spring were a warning that banks need to be more resilient, and need more of what is the foundation of that resilience, which is capital…”

But if they needed more capital, how would he explain to a public that fears the next bank crisis that the banks just quantitatively demonstrated that they have enough to survive it? Commenting on the stress test results last month, he said,

"This year's stress test shows that large banks have sufficient capital to withstand a highly stressful scenario and meet their minimum capital ratios. While the severity of this year's stress test is similar to last year's, the test resulted in higher losses because bank balance sheets are somewhat riskier, and expenses are higher. The goal of our test is to help to ensure that banks have enough capital to absorb losses in a highly stressful scenario. This test shows that they do."

Clearing All Repo

Capital is only part of the solution to preventing or at least making them a rarity. The public needs to fix the accidents waiting to happen. One of the perennial accidents waiting to happen is in the repo market, mainly those traded on a bilateral basis. The market depends on an intricate web of financial plumbing, and a backup anywhere in the system will ripple quickly through the markets, leading to market crashes and even bank panics. Clearinghouses are not perfect. They did not help in 1907. However, they could go a long way towards reducing the risk that the following bank panic will get started by the repo market.

Parties can trade through the central counterparty clearing house or trade bilaterally in a repo. Dealers clear most of their general collateral repo, but specials, for example, trade on a bi-lateral basis and a cleared basis. The Office of Financial Research estimated that the volume of bilateral repos is over $2.0 trillion. Meanwhile, total primary dealer repo volume equaled $3.8 trillion last month, of which over 70% is in the overnight term. With $0.6 trillion invested in repo according to their Q1 2024 call reports (Figure 1), the banking industry is the second largest investor in the repo market after the money market funds, which have $2.5 trillion invested.

Problems in repos have led to bank failures. In March 1985, the repo market caused 71 savings and loans in Ohio to fail when two secondary regional securities dealers, ESM Securities based in Fort Lauderdale, Florida, and Bevel, Bressler, and Shulman (BBS) based in Livingston, New Jersey, collapsed. The bankruptcies uncovered a significant fraud they had committed on local municipalities trying to invest liquid funds in the money markets. In those days, all repo transactions were bilateral. ESM took advantage of so-called safekeeping arrangements, leaving its collateral at Bradford Trust instead of delivering it to the municipal investors.

Figure 1: Investment In Repo: All Commercial Banks

But in fact, Bradford Trust claimed it never knew about any safekeeping arrangement with their collateral and that the dealers had kept it all comingled without distinction. The dealers had pledged the same Treasury collateral multiple times its worth for multiple repo trades at the same time. The municipalities who believed they were investing in Treasury repo, 0-risk, lost everything.

The collapse of ESM exposed another flaw in the financial system in 1985, where banks could offer depositors state or FDIC insurance to cover their deposits. When Home State Savings, a state-insured S&L, failed in Ohio, the cost to the state fund was large enough to wipe it out, which led to a run on other S&Ls in the state, and 71 of them failed.

Repo remains essential to a liquid market in Treasurys, and thus, the Fed, as agent for the Treasury, is keen to reduce vulnerabilities in the system. One of the reasons that ESM and BBS were able to get away with their fraud for so long was because they were exempt from registration under the SEC, as Governments are exempt securities, and by extension, dealers are exempt as well.

To try to fix an accident waiting to happen, in December 2023, the SEC adopted new rules to force bilateral repos to be cleared next year through a central clearing house party (CCP).

"Specifically, the amendments require that covered clearing agencies in the U.S. Treasury market adopt policies and procedures designed to require their members to submit for clearing certain specified secondary market transactions. These transactions include: all repurchase and reverse repurchase agreements collateralized by U.S. Treasury securities entered into by a member of the covered clearing agency, unless the counterparty is a state or local government or another clearing organization or the repurchase agreement is an inter-affiliate transaction...”

These rules are supposed to go into effect by March 2025, but there are costs. While all repo can move to the Fixed Income Clearing Corporation (FICC), only member dealers can clear their repo trades through it. While membership in the FICC is open, there are entry costs, and the benefits of requiring clearing in all repo transactions to reduce market risk are clear.

No Obvious Stress Signs

Trade data alone on bilateral, non-cleared repo could help bank supervisors track problems brewing early because if the market becomes imbalanced between cash and collateral, this may be the first place that signs of stress may show up. For example, signs of stress in the cleared repo market appear nonexistent.

The graph in Figure 2 compares the spread between the 99th and 1st percentile trades in the Secured Overnight Offered Rate (SOFR) comprised only of cleared trades in Treasurys. When there has been stress in SOFR, the spread has widened. For example, when the Fed was on the verge of hiking rates in March 2022 and through most of the rest of that year, the trading range for cleared repo widened significantly. In March 2020, at the onset of Covid, the spread between high and low widened to over 180 basis points. Generally, that range has been within 15-20 basis points, and on that basis, data from the cleared repo market implies that there is little to no stress in the repo market.

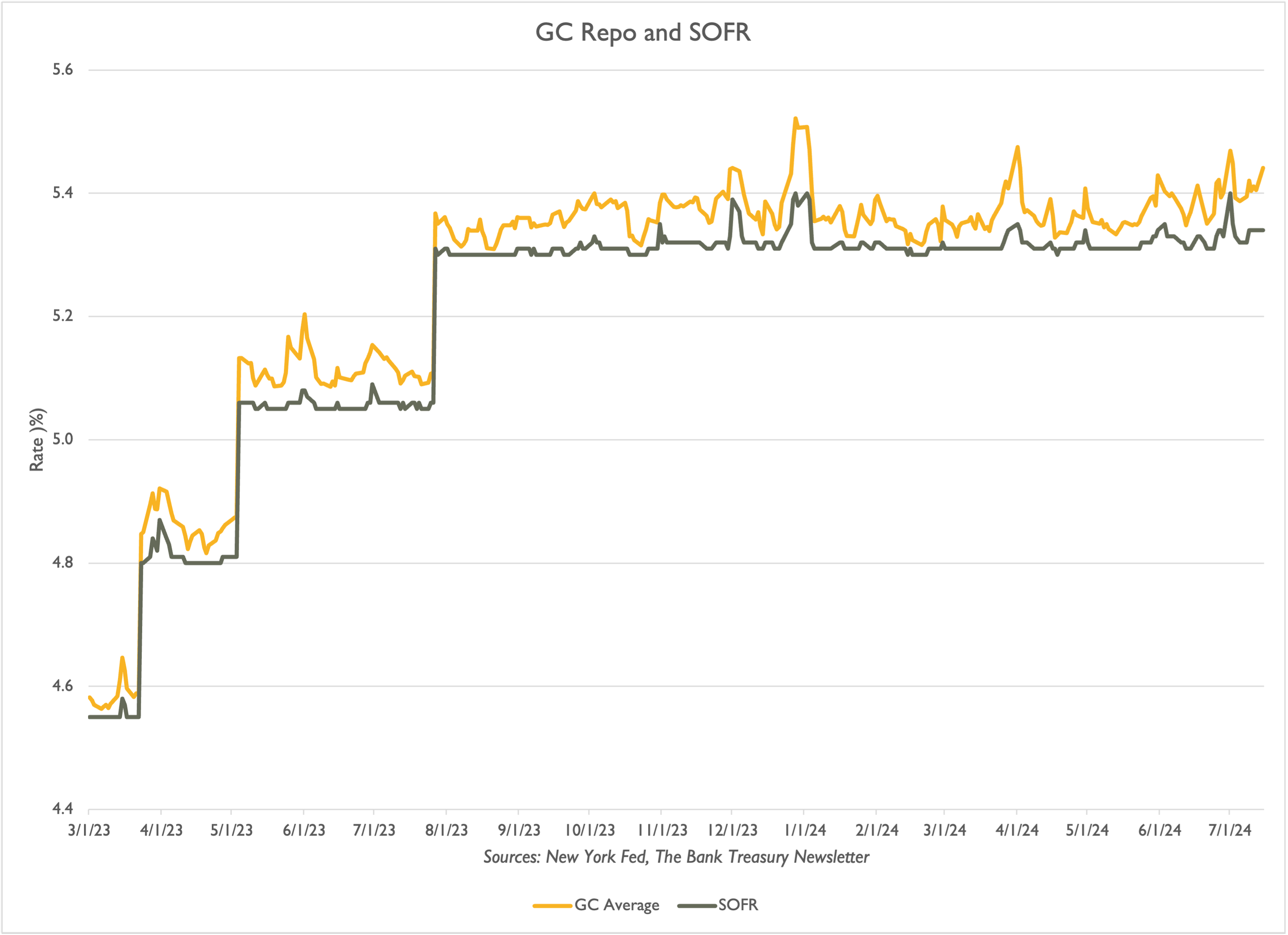

Figure 2: General Collater Repo and SOFR

But SOFR is only part of the story. The bilateral repo market is a different matter. Rates on general collateral (GC) repo are higher and fluctuate much higher than SOFR (Figure 3), and if pressures are forming in the repo market, they might show up there sooner than in the SOFR data. But even with the available information for that market represented by the average rate for GC repo, it is hard to see much liquidity pressure.

Bloomberg’s U.S. Government Security Liquidity Index tracks bid offers in the Treasury market, which might work as another signal of potential problems forming in the financing market. The index is complicated, incorporating the bid-offer spreads on Treasurys, auction results, volumes, and open interest in futures. Still, it can signal problems when the market absorbs new supply. With Treasury issuance up 41% year over year through H1 2024, bank treasurers and other market participants are particularly concerned to know as much as they can to prepare.

In 2022, the index began to flash red because hedge funds were reducing their investment in Treasury Futures, widening the basis with cash, and the regional bank crisis followed. But readings of most of these indices today, regardless of their construction and however reliable or unreliable they may be, suggest that market participants have little reason to lose sleep despite issuance volumes and negative investment flows from bond and equity funds that may signal that a future supply/demand imbalance is forming. Given that the Fed is already winding down QT, the odds are that tighter liquidity in the Treasury market is not a likely source for the next financial crisis.

Figure 3: Spread Between 99th and 1st Percentile SOFR

No Risk, and No Incentive to Take Any

In fact, according to bank managers who spoke to analysts this month to discuss Q2 2024 results, there does not seem to be much risk of any kind or much incentive to take any as banks. Given the capital requirements proposed last year with the Basel 3 Endgame, bank managers have been forced to refocus attention on shareholder returns over the cost of equity and put lending opportunities in the context of the amount of equity capital needed to support that exposure.

Thus, there is little incentive on the rate side to take on more duration risk, given the sharply inverted yield curve. Many bank treasurers are wondering how to extend the duration of their bond portfolios, maybe shifting some of the cash they have piled up at the Fed into bonds to lock in the current prevailing rates before the Fed starts to cut them. However, that strategy is expensive to execute with an inverted yield curve. As the CFO of a large global bank reminded analysts this month, extending duration in the bond portfolio means locking in a rate well below the overnight rate at the Fed.

“Given the inverted yield curve, it's not as if extending duration from these levels means that you're locking in a 5.4% rate.”

The cost of extending duration in Treasurys with an inverted yield curve is a powerful disincentive to go long today, but this might not be as true in the mortgage-backed securities (RMBS & CMBS) space where bank treasurers have been looking at investment in synthetic floating rate assets. These positions are constructed using a fixed rate RMBS or CMBS and a pay-fix/receive floating rate interest rate swap. With the yield curve as inverted as it is through 2 to 3 years, these swaps are economical to extend duration and hedge interest rate risk until the Fed begins to cut interest rates.

CME Group’s new Eris Innovations SOFR interest rate swap futures contract, created by one of this newsletter’s corporate sponsors, is an easy-to-access and use hedge accounting eligible way to construct such synthetic floating rate assets. Additionally, by buying agency RMBS or CMBS, one is getting a yield pickup over Treasuries, and with 2 to 5-year SOFR swap rates some 30 basis points below Treasury yields, there is a further pickup in hedging the agency MBS and CMBS positions with SOFR swap rates.

Credit remains solid, according to the chief credit officer of a small community bank in the Midwest,

“The credit quality is as good as it's been, since really the last 7 or 8, 9, 10 years. So, I am feeling really good about the loan book and asset quality.”

His view was a common observation on analyst earnings calls this month. The CFO of one of a large global banks, talking about the bank’s consumer book, told analysts that,

“I still feel like when it comes to card charge-offs and delinquencies, there's just not much to see. There is still normalization, not deterioration. It's in line with expectations…In my mind, this is…consistent with the type of economic environment that we're seeing, which is…a lot stronger than anyone would have thought.”

The commercial loan book is also performing well. Office CRE has a lot of risk, but overall, credit was good last quarter, according to the CFO of a second global bank,

“On the wholesale side, the losses that we've seen and the credit performance in the office CRE portfolio on is playing out no worse than what we expected when we set our reserve, but there's still uncertainty there…Things are still benign other than some episodic credit events and that is part of the wholesale business. But no real trend there.”

Credit might even improve, according to the CFO of a third global bank,

“We had a plateau in terms of delinquencies which means the second half…charge-off rate will be flattish… And then…CRE office…we expect the second half to be better.”

Some banks saw a little deterioration in some places and improvements in others, but overall credit trends were stable. As the CFO of a large regional bank on the east coast told analysts,

“Our total portfolio, CRE office aside, things are stable, maybe on quarter-to-quarter basis, consumer is a little bit better. Commercial non-CRE, is a little bit worse, but not bad. There were some downgrades, reflecting a higher rate and slower economic activity in our commercial book. But no patterns or any themes I'd point out.”

The president, CEO, and chairman of the same bank added,

“There's nothing in there that I think is going to surprise us.”

No surprises expected, said the CEO and president of a regional bank in the Midwest about his bank’s credit book,

“From where we sit, we don't expect surprises.”

No surprises, which is reassuring, yet surprising to say and reconcile with a world of uncertainty and daily surprise, from the geopolitical to the political, against a background of rising fiscal deficits, inflation, changing demographics, and disrupting technological innovations. Under these circumstances, who can feel reassured that they have not missed something in their analysis? Yet, panics habitually expose what they do miss and least suspect.

The next one is always another accident waiting to happen. And even though the risks are not apparent, surprises by their very definition are surprisingly surprising and tend to leap out of nowhere, like a jack-in-the-box.

The Bank Treasury Newsletter is an independent publication that welcomes comments, suggestions, and constructive criticisms from our readers in lieu of payment. Please refer this letter to members of your staff or your peers who would benefit from receiving it, and if you haven’t yet, subscribe here.

Copyright 2024, The Bank Treasury Newsletter, All Rights Reserved.

Ethan M. Heisler, CFA

Editor-in-Chief

This Month’s Chart Deck

A key message from bank management about Q2 2024 results is that the credit picture remains benign, consistent with the message it has been delivering every quarter since the Fed began to tighten policy in March 2022. Management is also confident that the bank credit portfolio holds no surprises. (See this month’s newsletter about surprises and panics.)

With a higher provision expense rate to average loans (Chart 1), reflective of management’s ongoing cautious outlook on credit, credit costs are below their historical norm. The slight blip-up in recent nonaccrual loans is more likely to be noise than an early warning signal (Chart 2). Nevertheless, rising office vacancies are a worrying trend (Chart 3). Over the last decade, the industry has been increasing its concentration in multi-family lending. It is running into some valuation issues with depressed property cap rates and delinquencies growing (Chart 4), though they are still modest by historical standards.

Yet, bank managers seem more relaxed about the economic environment (Chart 5) and are even seeing businesses increase credit demand, which they did not see last year (Chart 6). Regardless, neither bank willingness to lend nor the interest in businesses to borrow is back to where it was two years ago, in March 2022, before the Fed’s initial 25 basis point hike.

Liquidity conditions have been tighter in the financial system since the first hike. Still, according to the Office of Financial Research, they are better described today as balanced to modestly easy (Slide 7). There is still a lot of money floating around, which might partly explain why, in the credit space, the relative financing costs between the best and worst-rated corporate credit are holding below their historical average (Chart 8).

Theoretically, the Fed established the Standing Repo Facility in July 2021 as a fail-safe against sudden market liquidity shortages. But judging by spikes in the incidence of primary dealers failing to deliver since then, there is no perfect solution. (Chart 9).

Finally, while the economy is a leading topic in today’s political climate, U.S. newspaper headlines are spending less coverage on the topic (Chart 10), perhaps a reflection of its surer footing despite interest rates holding at more than a two-decade high.

Provision Expense Rate Runs Higher

Provision Expense, % of Average Loans and Leases, All Commercial Banks, Sources: Call Reports, FIS FedFis LLC, The Bank Treasury Newsletter

Credit Risk Remains Benign

Noncurrent Loans and Leases, % of Total Loans and Leases, Sources: Quarterly Banking Profile, FDIC, The Bank Treasury Newsletter

Office Vacancy Fallout From Work From Home

U.S. Office Vacancy Rate, Sources: Colliers International, Statista.com, The Bank Treasury Newsletter

Cap Rates Hit Property Loan-to-Value

Noncurrent Loans Secured by Multifamily Residential Property, % of Total Multifamily Loans, Sources: Quarterly Banking Profile, FDIC, The Bank Treasury Newsletter

Economy Less Of A Factor For Credit Approval

Number of Domestic Banks that Tightened and Reported that a less Favorable Economic Outlook was a Very Important Reason, Sources: Senior Officer Opinion Survey on Bank Lending Practices, Federal Reserve, The Bank Treasury Newsletter

Treasury Outstandings Climb To Over $24 Trillion

Net Pct. of Domestic Banks Reporting Increased Number of Inquiries for C&I Loans, Sources: Senior Officer Opinion Survey on Bank Lending Practices, Federal Reserve, The Bank Treasury Newsletter

Credit Risk Does Not Pay

Credit Stress: Difference in Borrowing Costs for Firms of Different Creditworthiness, Sources: Financial Stress Index, Office of Financial Research, The Bank Treasury Newsletter

Balanced Liquidity, Slightly Easy

Relative Difficulty or Ease for Financial Institutions To Finance Their Balance Sheets, Sources: Financial Stress Index, Office of Financial Research, The Bank Treasury Newsletter

Treasury Market Volatility Signal

Primary Dealer Statistics: Fail to Deliver Aggregate Treasury Securities, Sources: Primary Dealer Statistics, Federal Reserve Bank, Office of Financial Research, The Bank Treasury Newsletter

Economic Policy Uncertainty Fades

Economic Policy Uncertainty Index, Sources: FRED, St. Louis Fed, The Bank Treasury Newsletter