The newsletter, which is in its 19th year of operation, is once again on an independent platform and we look forward to continuing with monthly reporting on news in the bank treasury space.

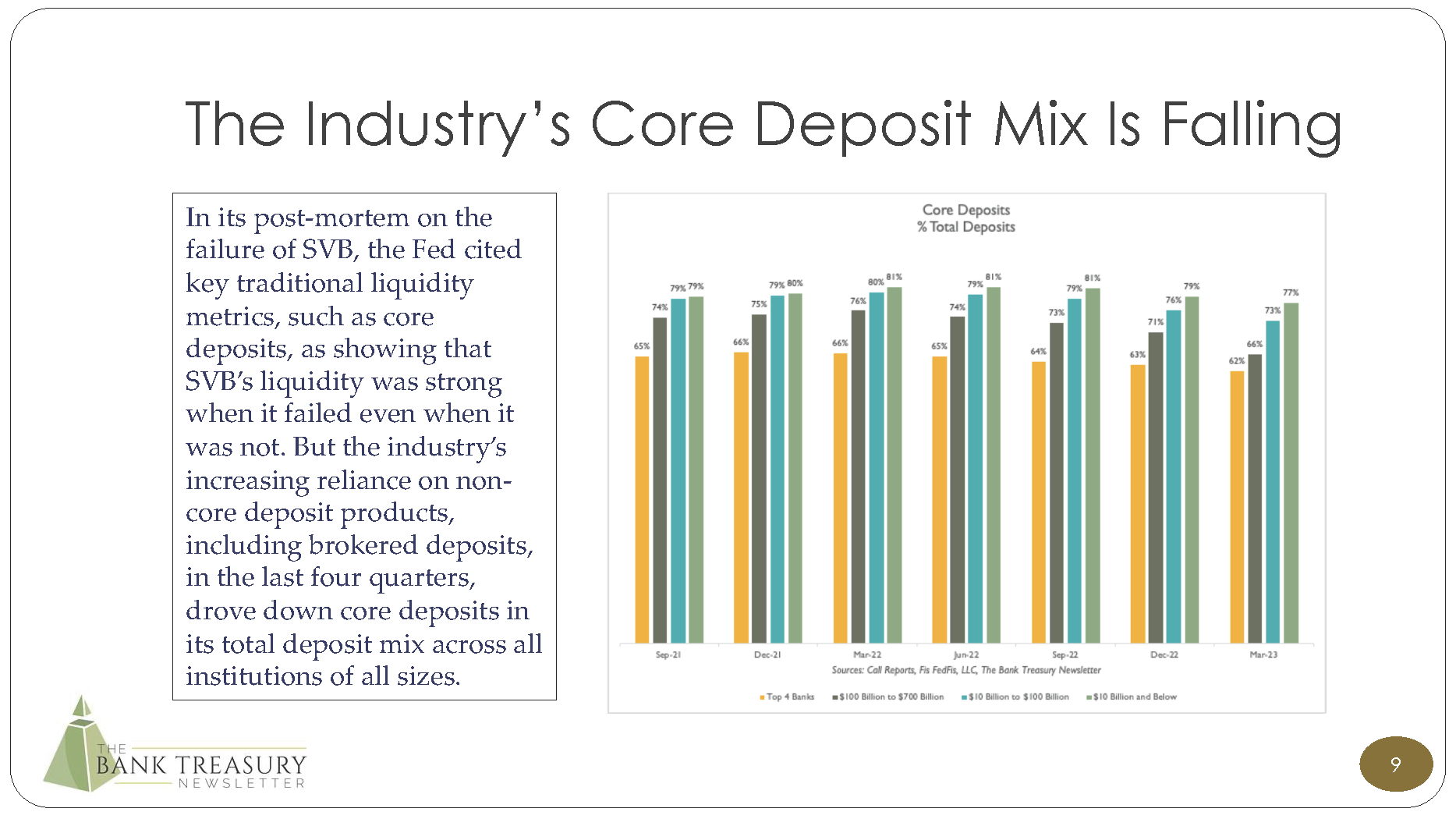

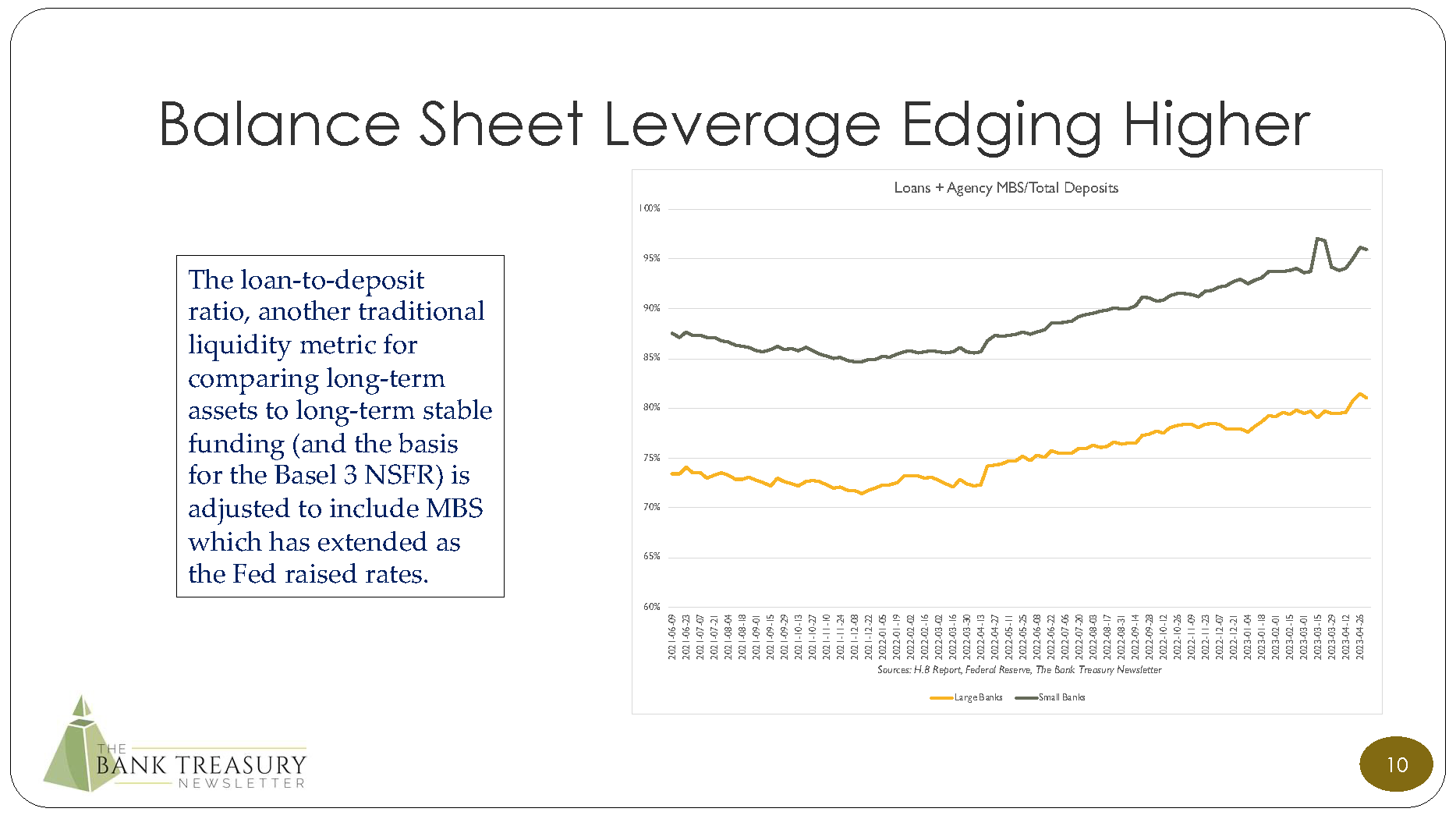

This month’s newsletter discusses key takeaways and implications from post-mortems by the Fed and the FDIC on the failure of Silicon Valley Bank and Signature Bank that they released at the end of last month. The bank regulators cast as much blame on their own institutional failures as they assigned to bank management. Bank treasurers expect that accounting rules and liquidity metrics will need to be adjusted and regulation of interest rate risk will be more tightly supervised. The also expect to hold more cash on their balance sheets after everyone gets finished reviewing the models and trying to incorporate the risk that deposit repricing beta for a given deposit product could suddenly go from a low percent straight up to 100% overnight.

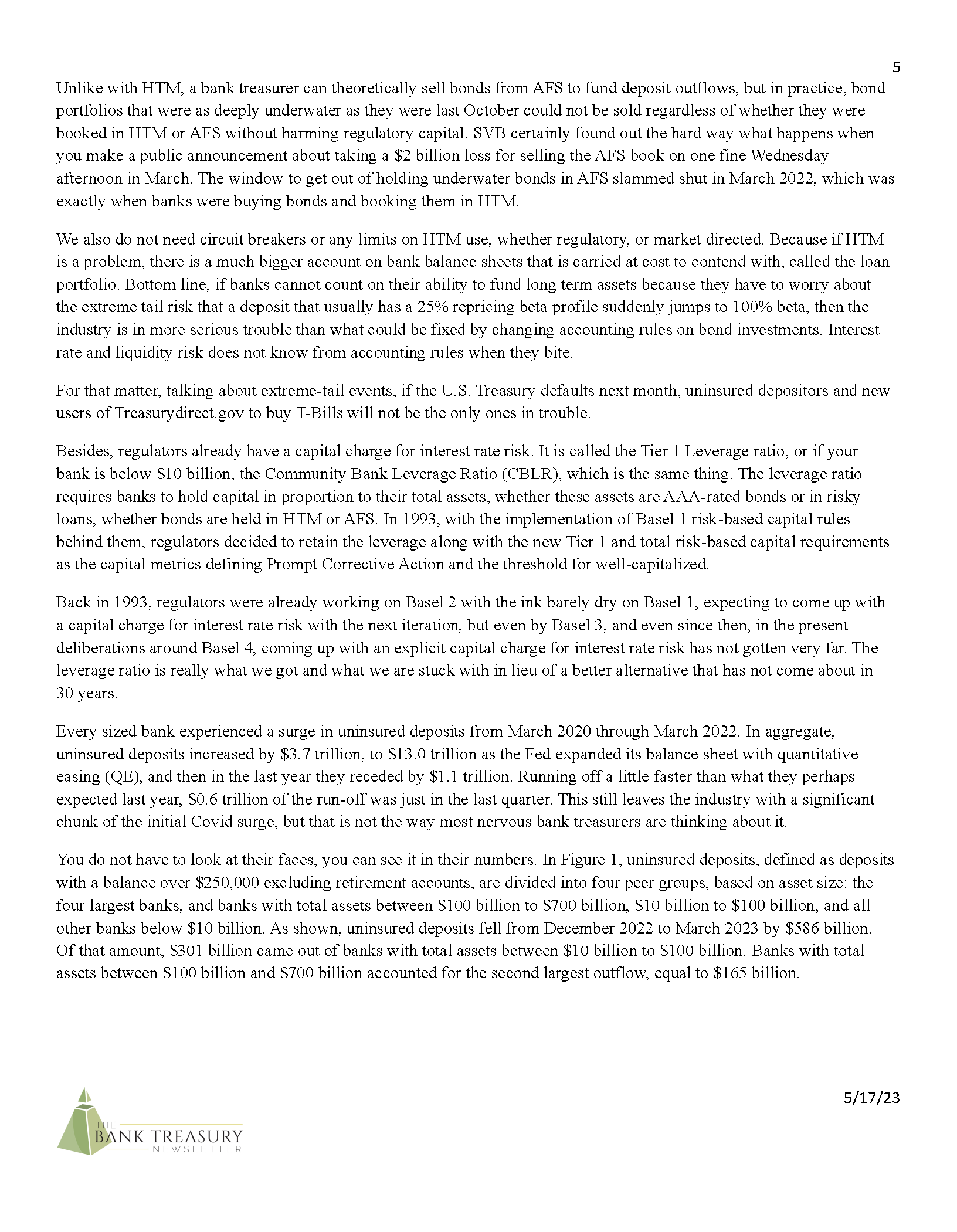

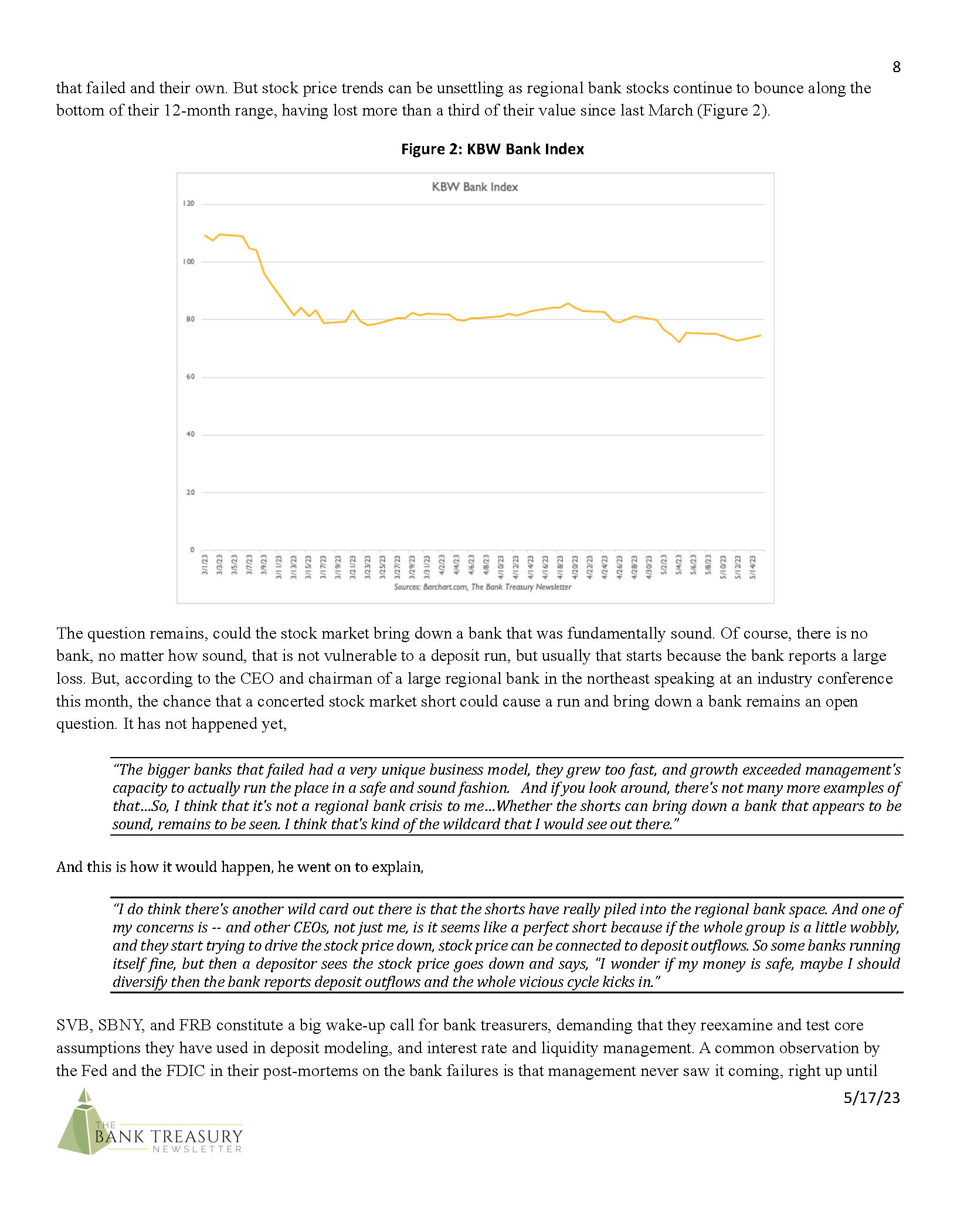

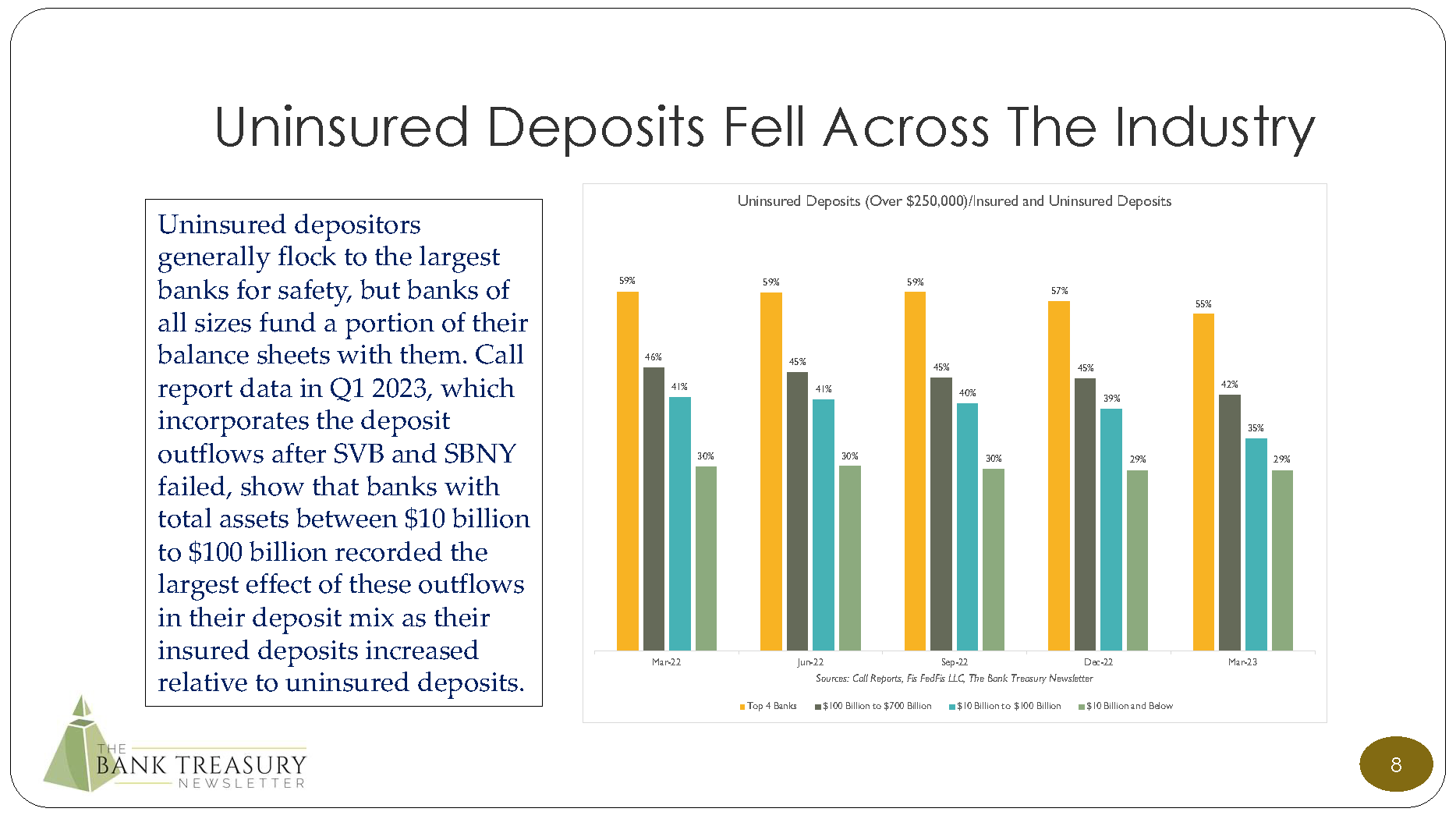

The newsletter discusses how the use of held-to-maturity to shield banks from negative Accumulated Other Comprehensive Income became more prevalent across the industry and size spectrum as the Fed’s rate hikes progressed, with the largest banks holding the highest proportion of their investment portfolio in it. It also shines a spotlight on uninsured deposits, which became another focal point in the bank failures this year, and how the largest banks account for the highest mix in their funding and saw the largest declines last March. Finally, the newsletter discusses why bank treasurers are paying closer attention to stock prices as regional bank stocks remain stuck at the bottom of their 12-month price range.

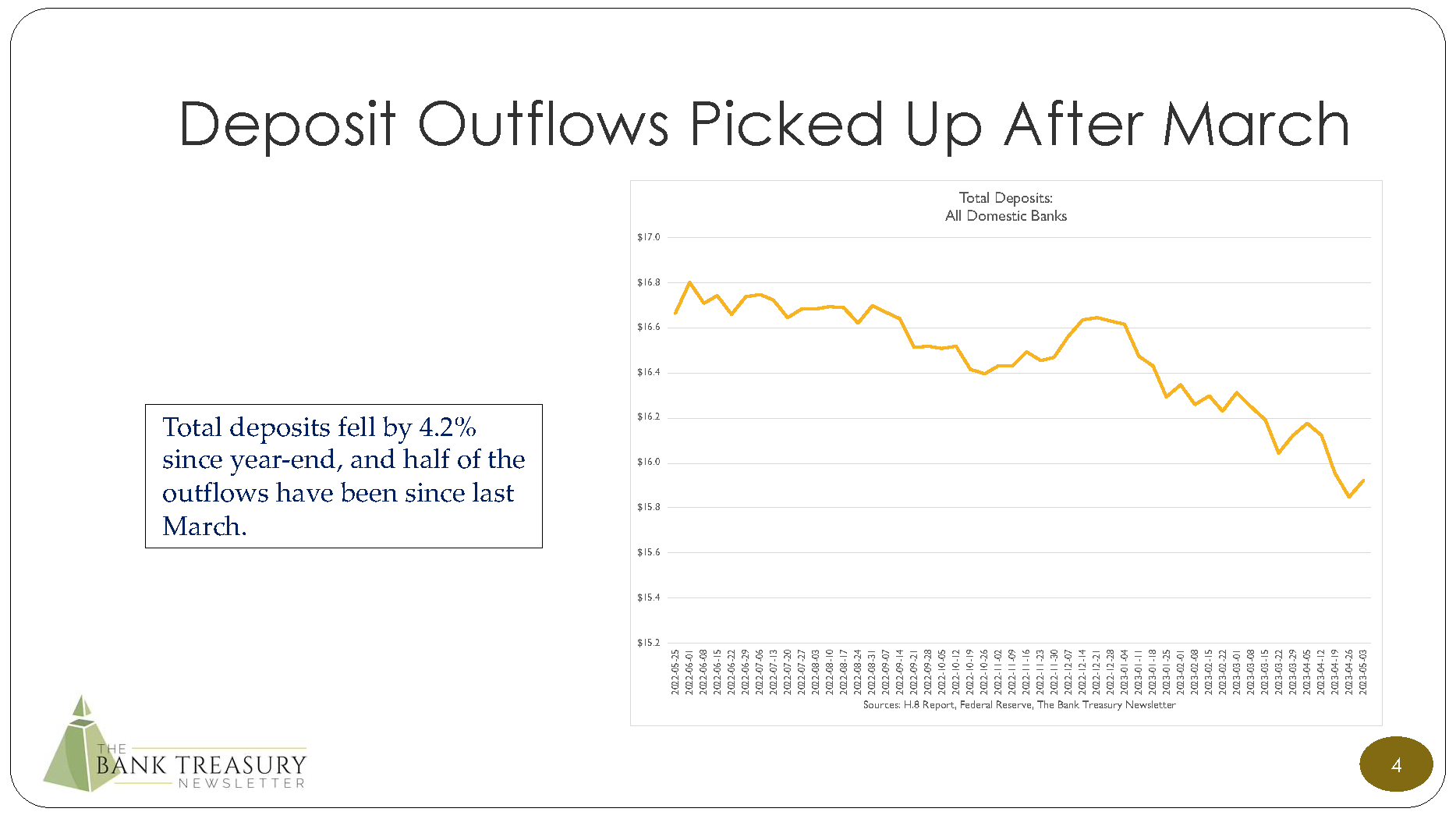

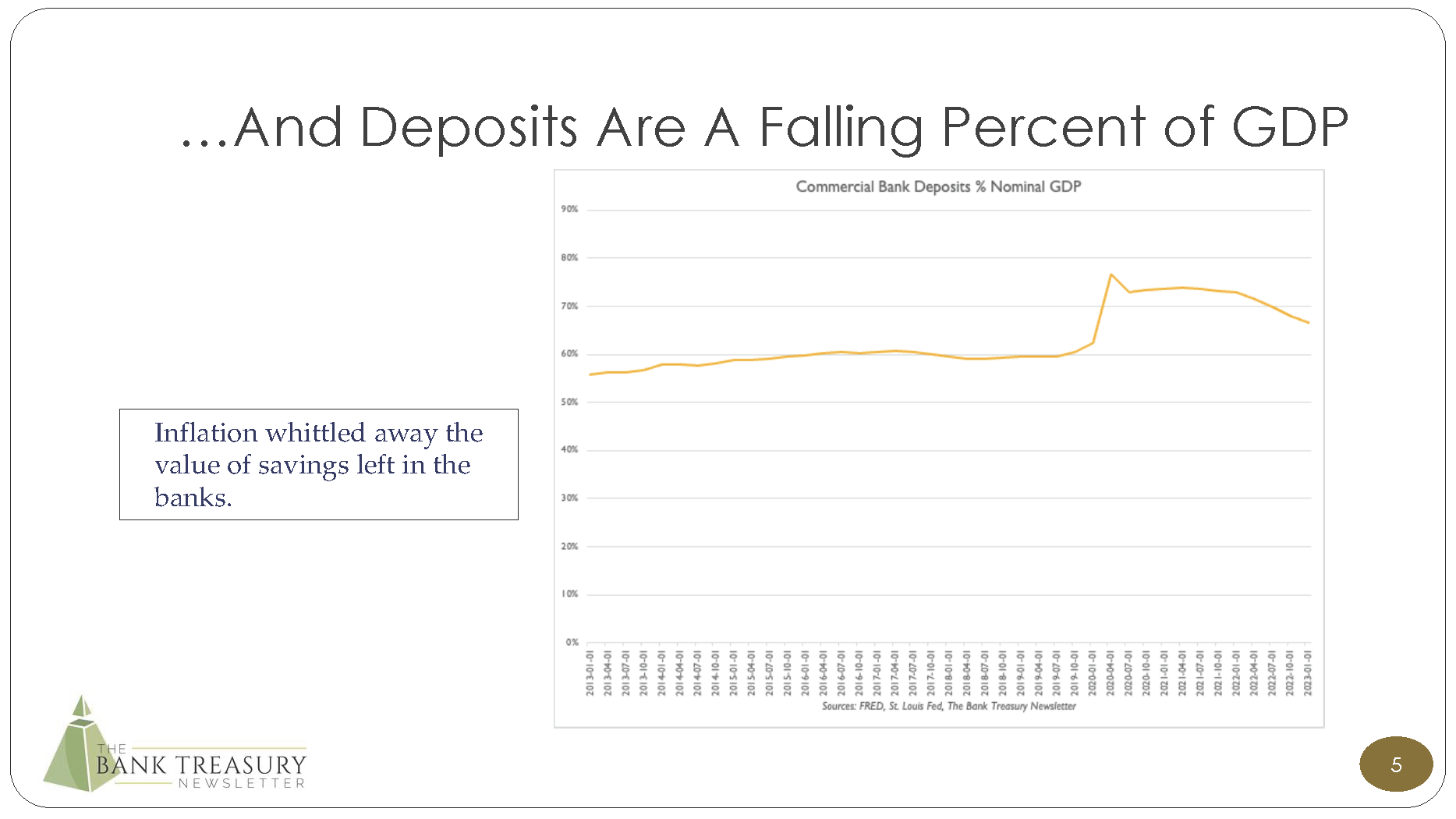

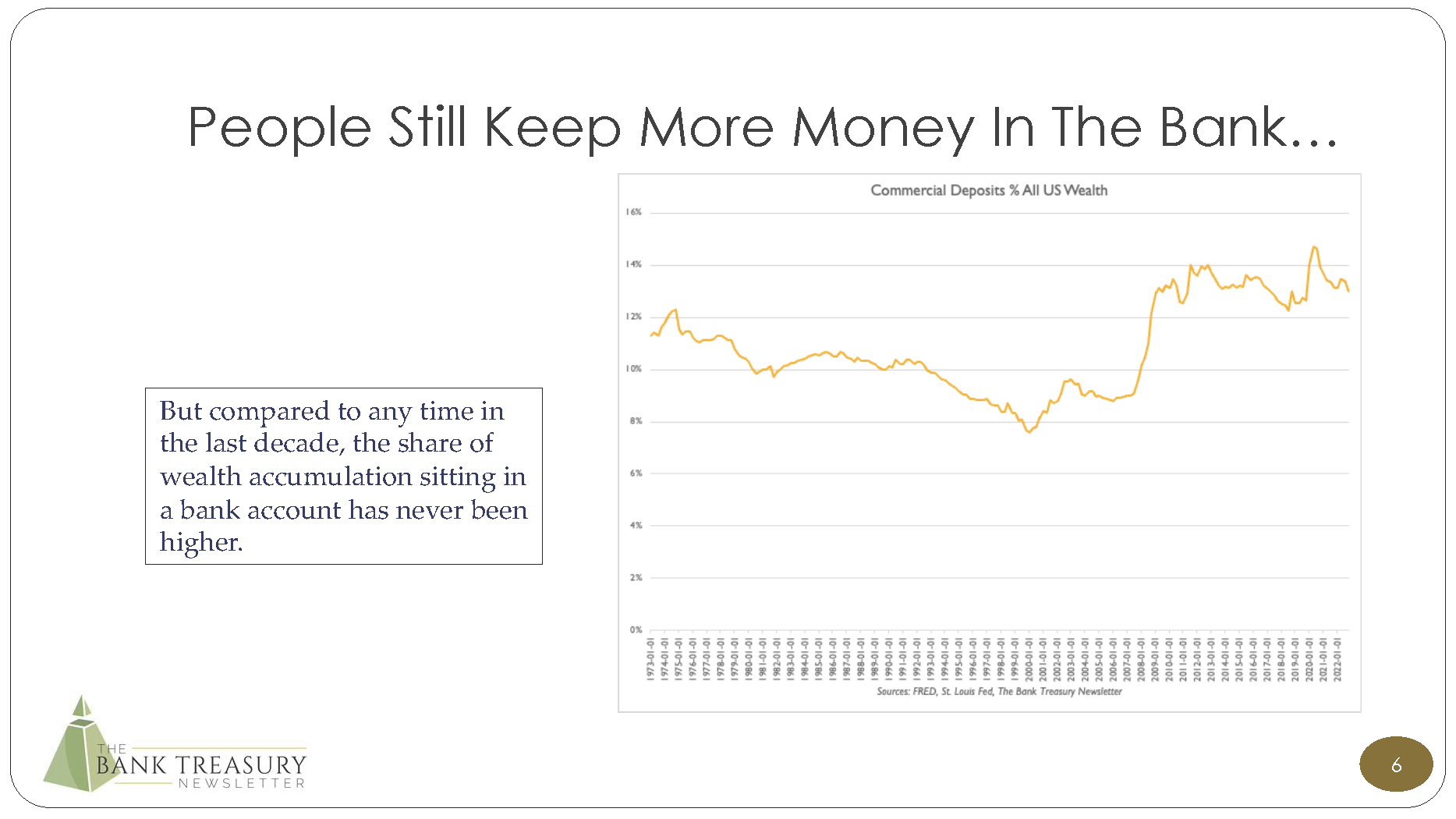

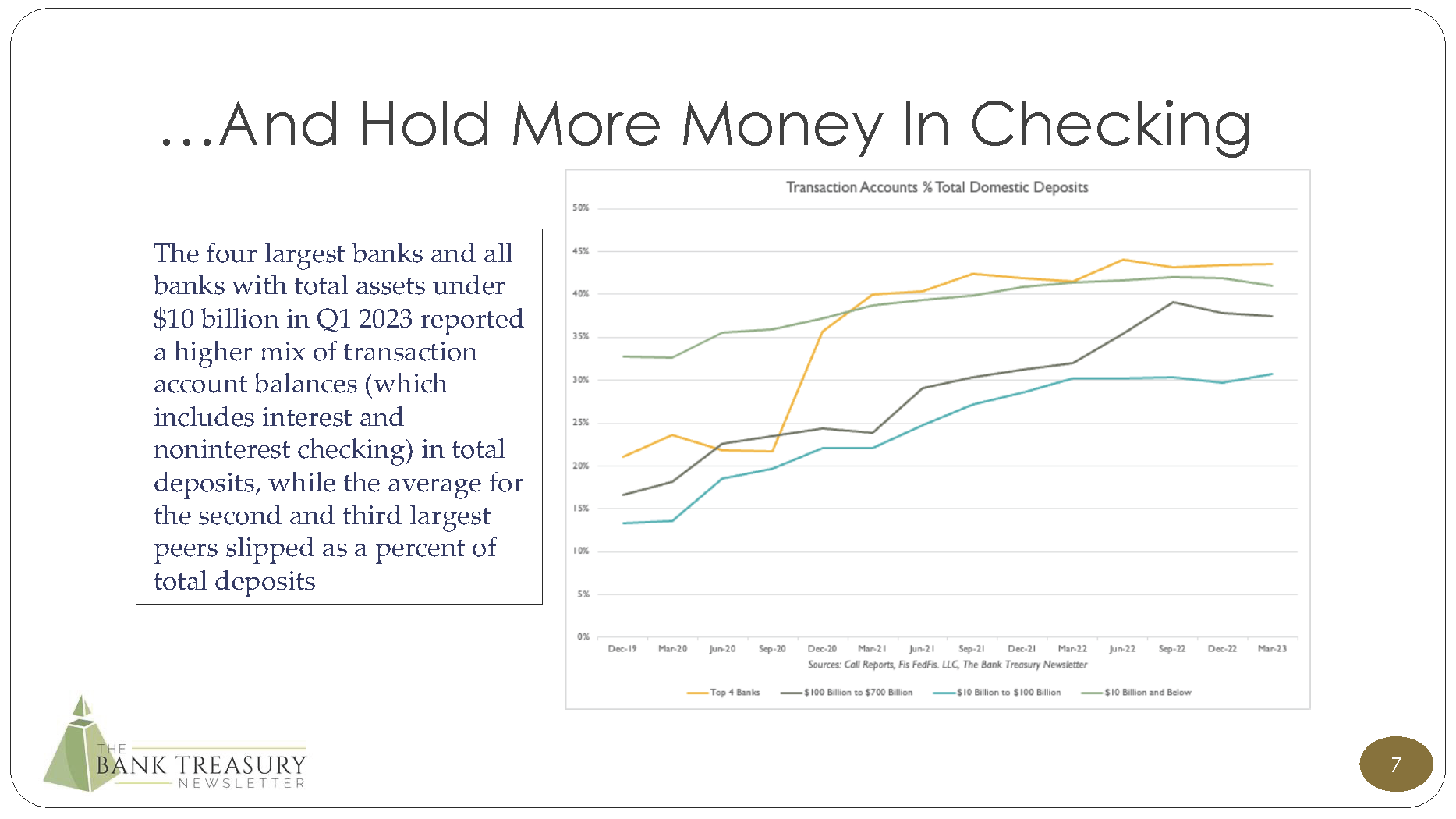

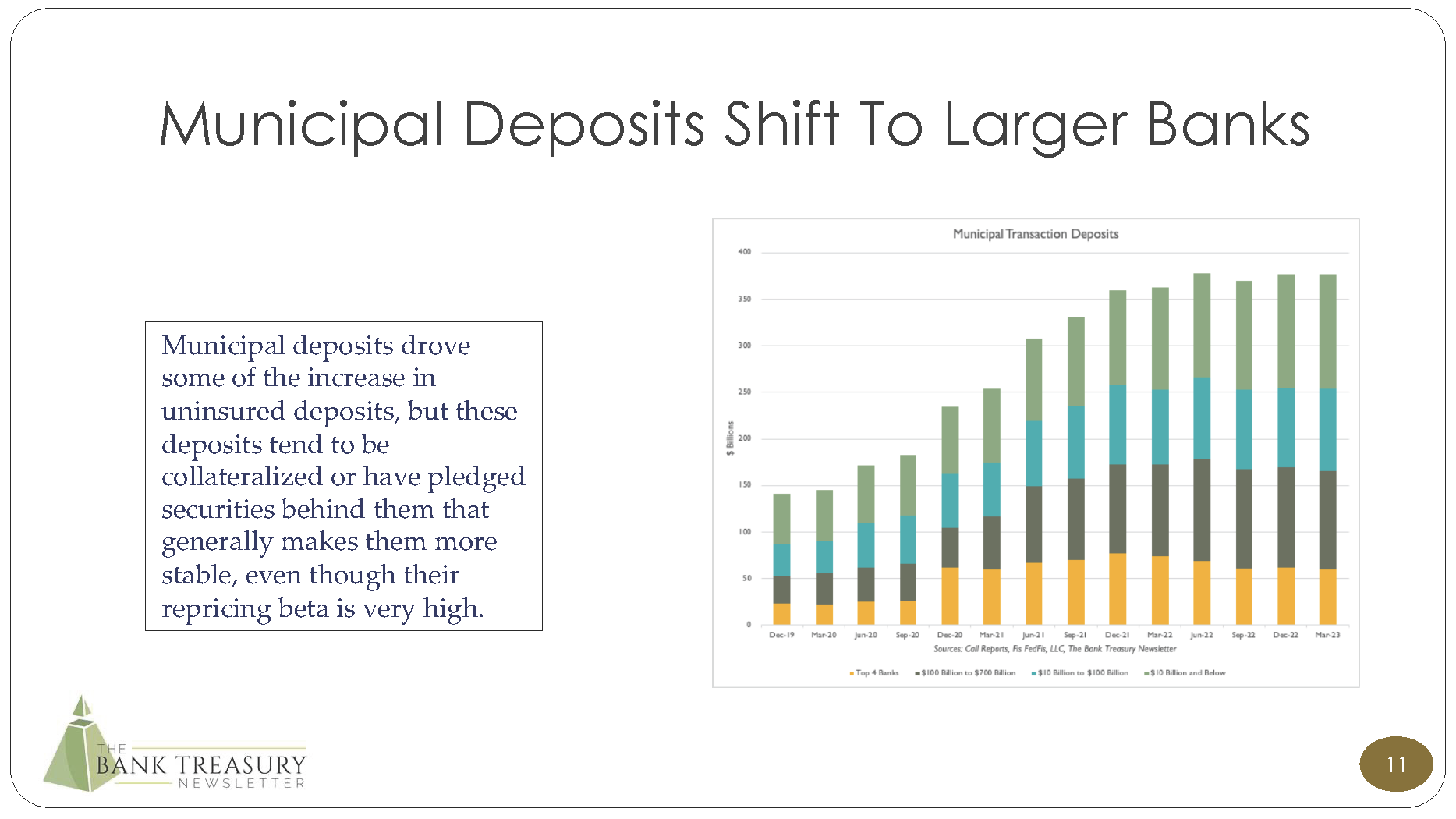

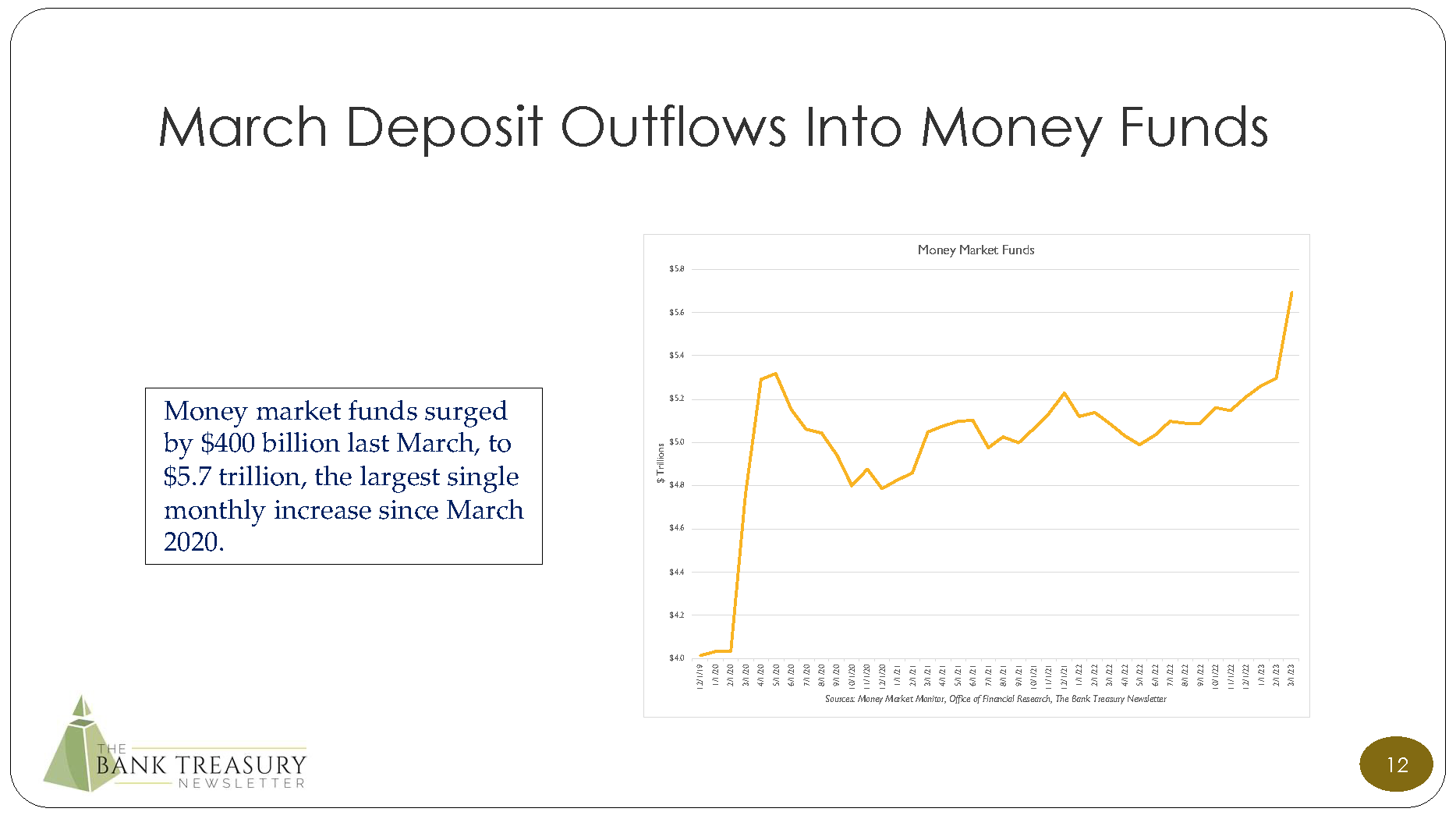

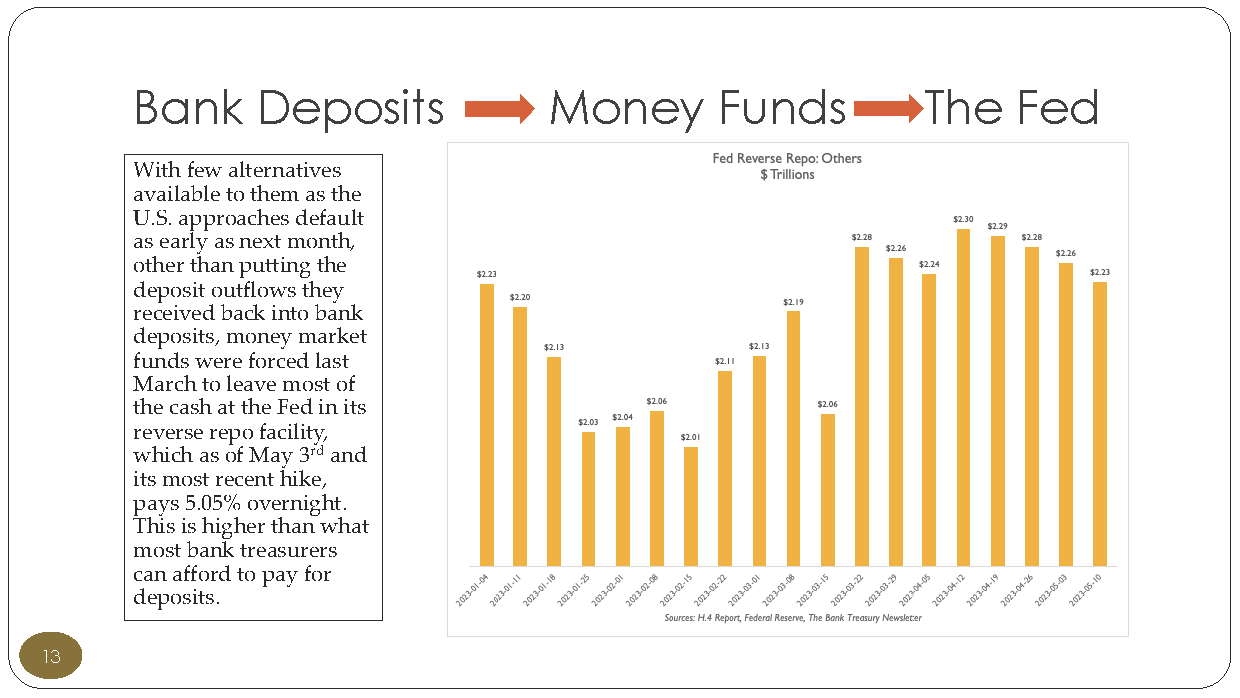

Continuing with the focus on uninsured deposits discussed in the newsletter, this month’s chart deck takes a broad look at recent deposit trends. The deck includes slides on transaction accounts and municipal deposits and compares deposits to GDP and the total balance of U.S. wealth. The last slides in the deck make the point that the money market funds, serving as a flight to safety and a source for higher returns, had little choice but to store most of the deposit outflows they received at the Fed in the Reverse Repo facility which reached $2.2 trillion.

The last year has been “fun,” it got even more fun since March, and judging by how the debt ceiling negotiations are going, the fun isn’t over.