BANK TREASURERS REMEMBER ZENO

The CME FedWatch monitor currently puts the odds that the Fed stays on pause at the Federal Open Market Committee (FOMC) meeting next month at over 90%, but bank treasurers are still hoping for one or two cuts by the second half of this year. They also do not dismiss the risk that the Fed may hike rates in 2025 and seek to neutralize the effect of changes in short-term interest rates on Net Interest Margin (NIM) and Net Interest Income (NII) through receive- and pay-fixed interest rate swaps. The new Eris SOFR Swap Futures contract that trades on the CME can be an economical alternative to using swaps for hedging, as many bank treasurers have been learning in the last year.

The Fed's balance sheet continues to shrink under tapered caps for Treasurys and Agency Mortgage-Backed Securities (MBS) under quantitative tightening (QT). Since July 2022, when QT began, the Fed shrank its balance sheet by $2.2 trillion to $6.7 trillion this month. During this time, the balance of its reserve deposits was unchanged at $3.3 trillion. Treasury traders are nervous about the Fed's plans for QT and when it will end. They recall the disruption in the repo markets in September 2019 after the Fed had finished shrinking its balance sheet in July 2019 because there had been a temporary shortage of reserve deposits.

Slight increases in general collateral repo rates over the reverse repo rate also worry them, suggesting that the Fed's ongoing QT could lead to a similar disruption. However, in September 2019, reserve deposits equaled $1.4 trillion. As a study by the Fed this month noted, so far, there is no indication that there is anything other than an abundant amount of reserves to meet demand. Meanwhile, the latest Fed minutes suggest that the Fed could pause QT until Congress resolves the Federal debt ceiling.

Starting next month, new rules by the Securities and Exchange Commission (SEC) will begin a transition that, by mid-2026, will require market participants to centrally clear of all Treasury trading and repurchase agreements. Dealers, regulators, and all other market participants generally agree that expanding the scope for clearing trades will reduce settlement risk and potential disruptions in the Treasury market. However, concentrating securities clearing within a single clearinghouse also makes the clearinghouse too big to fail and increases systemic risk.

There is nothing new about clearinghouses as they have been around since the beginning of the 19th century in the U.S., and the dangers they can pose are well known. Tokenization and distributed ledger technology offer an alternative way to improve efficiency in trading markets and reduce market dislocations. Applications in the repo market are growing, and tokenization offers automated compliance and settlement, enhanced security, and transparency.

Fed Governor Christopher Waller said that the Fed was studying the application of tokenization to reserve deposits. On the other hand, efforts to create a Central Bank Digital Currency (CBDC) appear to have ended given the executive order last month telling the Fed to shut down further work on the project. However, even before the order came out, the Fed was never likely to get very far with the CBDC project. To not disintermediate the banking industry, the public would need a bank account to own CBDC, and ownership and transactions using it could not be anonymous, both of which are nonnegotiable conditions to get the public interested in using it for payments.

This month, the White House published another executive order requiring independent federal agencies, such as the Federal Reserve, to get the Administration's approval before publishing new rules. How this order will impact the fate of the Basel 3 Endgame, which the Fed pulled last year for re-drafting, is unclear. Bank managers have been clear about how they expect bank supervisors to lighten their touch going forward. In that regard, following Michael Barr's decision to resign as Vice-Chair of Supervision this month, Jay Powell told the House Financial Services Committee that he believed that the role of Vice-Chair was unnecessary as the Fed functioned well before the Dodd-Frank Act created it.

The Fed published the Dodd-Frank Act stress test scenarios for the large banks this month which included two exploratory stress scenarios, one involving large-scale credit and liquidity shocks in the non-bank sector and another which involved the failure of five major hedge funds. The latest Monetary Policy Report by the Fed published this month observed that financial conditions for the banking industry remain stable. In one of his final speeches as Vice-Chair of Supervision, Michael Barr emphasized the importance of maintaining the dynamism of the stress tests by incorporating new stress scenarios. Bank management remains generally optimistic about loan growth picking up this year.

The most recent Senior Loan Officer Opinion Survey (SLOOS) identified some moderate pick-up in loan demand, but H.8. data shows that there has been no pick-up yet despite banks reporting increased inquiries and underwriting new credit commitment lines. With the sell-off in the 10-year Treasury last quarter, the difference between the total investment portfolio's fair value and amortized cost grew from $360 billion to $500 billion, of which $300 billion relates just to the Held-to-Maturity portfolio. The book yield on the industry's total MBS portfolio equaled 2.6% in Q4 2024, well below marginal funding costs.

The Bank Treasury Newsletter-February 2025

Dear Bank Treasury Subscribers,

Zeno of Elea was a philosopher who lived in Greece in the 5th century BCE. It was the golden age of philosophy back then, and every college student in the country majored in it. Guys like Socrates were running around in togas corrupting the youth, and university humanities department chairs did not need to worry that STEM studies would take their funding or give two figs for college philosophy majors and their post-graduation plans.

Zeno is famous for a set of paradoxes around infinity and motion, involving a race between a runner named Achilles and a tortoise with a head start and an arrow shot from a bow suspended in mid-air. Most bank treasurers have probably never heard of Zeno or maybe have him confused with the other Zeno from the 3rd century BCE. That Zeno invented stoicism, which is practically a religion with bank treasurers. Zeno’s paradoxes have mystified bank treasurers forever, even if they have no idea who he was. Still, his paradoxes are a fraction of the paradoxes that are grabbing their attention these days.

Central Banking Paradoxes

The Fed is one big paradox of paradoxes. Exhibit A, for example, is the monetary policy paradox, a famous paradox observed by 20th-century economist Irving Fischer, which goes like this: to control inflation, the Fed raises short-term interest rates. However, high interest rates correlate to high-inflation economies and low interest rates to low-inflation economies. So, when the Fed raises interest rates to rein in inflation, it will need to lower rates again when inflation subsides, which will only spur it back to life.

And, while our subscribers try to twist their heads around that paradox, they can also think about the central bank paradox: central banks, by controlling interest rates, cause business cycles that threaten financial stability. Central banks, of course, are designed to ensure economic stability. But when the Fed raises interest rates to rein in inflation, the hikes cause, or are supposed to cause, a recession (not counting the last cycle, obviously), which leads to massive bankruptcies and all hell breaking loose. When the business cycle sours, the market demands the Fed step in and save everyone, which leads the Fed to take even tighter control over interest rates, which leads to the next cycle.

John Maynard Keynes's classic thrift paradox is next on the list of central bank paradoxes in the world of bank treasury world is John Maynard Keynes's. Everyone knows that thrift is good and that saving money is how economies gather capital to invest in the future. But the funny thing is that thrift can lead to underconsumption, which is unsuitable for the U.S. economy, where spending drives most of the growth. But worse, thrift can lead to poverty because under-consumption, if it persists, can cause recessions, which can drive up unemployment and lead newly unemployed savers to draw down on their savings to get by until the economy comes out of recession. They can find a job, after which they can start saving again and cause another recession.

Then there is the money paradox: money can be a store of value or a means of transaction but cannot be both simultaneously. According to the laws of entropy in physics, things in a high-energy state eventually transition to a low-energy state. The money you keep in your wallet to buy things is in a high-energy state. You have no intention of holding it in your purse indefinitely, and eventually, you even break that $100 bill. On the other hand, the cash you pull out of the ATM and stash in a safe deposit box when you worry that some numb nut will expose the whole banking system to a cyber-attack or the zombie apocalypse is in a low-energy state. Like the $2 bill you keep in your wallet, you will never spend it, and it will never have a stimulative effect on the economy.

Imagine you are a central banker and decide to create money to stimulate your economy. Assuming the public does not just sock it all away in a safe deposit box, that money you make is high energy. The public is going to use it to buy that water ski and that 75-inch OLEG television, and then the stores that sold these things will turn around and use the money received in the transaction to buy more inventory from suppliers who will turn around and use the money to acquire more supply, and so on and so on.

High-energy money will do a great job stimulating the economy, but eventually, entropy kicks in, and the cash created effectively transitions to its stored value state. When money is still in its transaction state, it still has the power to stimulate the economy. Still, when it ultimately finds its way into a safe deposit box, it may be time for the central bank to create more money if it is still trying to stimulate the economy. Knowing when money has made the final transition or could still get pulled out of the safe and maybe spent is the art of central banking.

Risk Mitigation Amplifies Risk

Risk has its own set of paradoxes. For example, take the SEC's new clearing rules for trading Treasurys and repo that begin to kick in next month and be fully effective by June 30, 2026, expanding the scope of trades that market participants need to centrally clear. These days, it is always possible that the new sheriff in town will suspend or even reverse rules like these. However, regulators and market participants generally agree that clearing is a good thing because it reduces settlement risk and capital requirements for GSIBs.

But if you know about the systemic risk paradox, when you try to reduce credit risk for large banks by pushing them to clear everything, you concentrate systemic risk into a single clearinghouse. So, in trying to mitigate systemic risk for GSIBs, the SEC's new clearing rules may end up increasing systemic risk anyway since the GSIBs are the owners of the clearing house. If the clearing house gets into trouble, which is not inconceivable, it would be a disaster for trading and the GSIBs.

One way around this paradox is to push the market to tokenize financial instruments. Tokenization encrypts sensitive data into a digital version that users can transact over a distributed ledger system, such as the blockchain. Assets, liabilities, homes, bank accounts, and pretty much everything can be tokenized. Fed Governor Waller said this month that the Fed was exploring tokenizing bank reserve deposits, for example. Tokenized repo is another application of the technology that promises to reduce settlement risk, promote market transparency, and improve trading efficiency. Severe market disruption, such as in September 2019 and March 2020 when the Covid lockdowns began, theoretically could be averted with tokenized repo.

Around the time when Covid struck, the Fed began to study the feasibility of a central bank digital currency (CBDC), tokenized cash, to replace paper money. Late last month, a new executive order slammed the door on CBDCs, but the project had already hit a dead end. Yes, tokenized cash would help speed payments and reduce the cost of wire transfers. However, the point of using paper money is to pay anonymously, which, from the Fed's standpoint, would be impossible.

First, only regulated banks, primary dealers, and approved counterparties such as the money market funds can do business directly with the Fed. Second, tokenized cash is outside the Fed's control and could facilitate money laundering. So, the public would need to work through banks, and transactions would not be anonymous if CBDCs were to replace physical currency one day. However, if transactions are not anonymous, the public is unlikely to be interested in using it since the whole point of using cash in transactions is anonymity. Contrary to predictions that cryptocurrencies will one day replace the US dollar, public demand for digital money, much less crypto for payments, remains very low. The Fed's latest payment study found that the public uses credit cards to complete most payments.

Tokens can also be programmed to activate only when holders meet certain conditions, a feature of the cryptocurrency, Ethereum, which the market could incorporate in the design of a tokenized repo. However, programmed tokenized financial instruments designed to reduce systemic crises can amplify systemic crises because of the programmability paradox. Once the tokens are created and programmed, no intervention by the Fed could stop them from activating a run on the system.

Moral Hazard Never Goes Away

The bank failures two years ago exposed a key paradox about the Fed's discount window and its role as a lender of last resort. The window is theoretically a lifesaver for a bank during a deposit run. But a bank treasurer would want to avoid the discount window like the plague because of the stigma effect and the risk that, when news comes out that the bank had tapped its primary credit line with the Fed, the run will only intensify, and failure becomes inevitable. Paradoxically, given that it promotes itself as lender of last resort and complains that it is not the role of the FHLBs to lend to a failing bank, the Fed has the option to deny a loan to a member bank under Reg A for any reason and especially if the bank is undercapitalized.

While bank treasurers celebrate the great regulatory rollback they anticipate, thanks to new leadership at the regulators, they would do well to remember the moral hazard paradox. The paradox says that bailing out big banks encourages moral hazard, but not bailing out big banks or taking away the Fed's statutory authority to bail out banks and other market participants when they get into trouble may lead to an even more significant emergency, require an even larger bailout, and ultimately lead to more moral hazard.

Taxpayers do not want the government bailing out the too big to fail, whether big banks or big clearing houses. That is fine if that is what the public wants. But suppose systemic failure is also not an option. In that case, Congress should not come crying for their constituents because higher capital and liquidity requirements placed on the too big to fail to ensure that they can never get into trouble and imperil the financial system again, which means that some constituents cannot get the loan they got before. Credit denied to their constituents who are not profitable enough to support the tighter regulations is the cost of avoiding moral hazard at all costs.

Bank safety and soundness regulations come with their own set of paradoxes. For example, the public wants banks to hold sufficient capital and liquidity to manage through a crisis, and after every crisis, the call for higher capital and liquidity resources follows. However, since there are never enough equity investors seeking utility-like returns, as former Fed governor and vice-chair of bank supervision Randy Quarles pointed out, higher capital and liquidity requirements only drive businesses out of regulated banks into unregulated nonbanks. It also leads to consolidation, which creates more institutions that are too big to fail.

The worst part is that even after the GSIBs stock up with Total Loss Absorption Capacity long-term debt and a Global Systemic Important Bank capital surcharge, after they boost their buffers on LCR and NSFR, and after they finish addressing all the deficiencies, the FDIC found in the last edition of their living wills—the irony is that none of this will matter. If, say, the largest banking organization in the US were to teeter on the edge of the abyss suddenly, the Fed and the FDIC would be foolish if they did not intervene immediately to prevent disaster, maybe faster than a token can move on the blockchain. When all else fails, every systemically important financial system player knows there will always be a bailout.

The only decision the Fed needs to make is whether to intervene early and possibly contain the crisis or wait for the crisis to burn everything to the ground and then intervene when the cost is higher. However, the next time a crisis strikes, it may not be enough to lower rates again to 0% to save the financial system. According to the price flexibility paradox, the public's inflation expectations might turn deflationary after a crisis. In that case, cuts to 0% could still leave real rates higher than before the crisis because the public would expect inflation to fall and the Fed to keep rates low for a prolonged period. Conversely, when inflation increases, the public expects the Fed to fight inflation by keeping rates high, which can reduce real rates, which could stoke inflation. The next time we get into a crisis, the Fed may need to bone up on negative interest rate policy (NIRP), even though NIRP presents its paradoxes as Japan, for example, discovered.

Market Paradoxes

Bank treasurers have a lot of experience with market paradoxes. For example, it might seem like common sense to buy low and sell high, but being experienced traders as they are, they know all too well about the buy low and sell high paradox, where assets that trade cheaply go on to trade cheaper and assets that are rich often go on to trade richer. Then there is the "Powell" paradox, where the market's anticipation that the Fed will cut rates leads to rates lower before the rate cut, which stimulates the economy, pushing up economic readings that lead the Fed to delay the anticipated cuts.

Transparency Paradox: What You Need to Know

The Fed is always talking about transparency, about how its monetary policies must be transparent to the public. In this regard, today's public can access an economic policy statement after each FOMC meeting and meeting minutes a month after those meetings. There are dot plots, which are representations of the dispersion of projections for inflation and rates among the voting and nonvoting members of the FOMC. And, of course, the Fed is data dependent, which means the trading markets can follow along in real-time with the Fed as economic trends unfold. Thanks to all their communications, where the Fed first predicts a lot of rate cuts this year, much less hikes, then even opens the door to hikes, makes it very transparent to market participants that the Fed is leading blind.

Transparency is also the word of the day in bank supervision, even before the new sheriff arrived in Washington, D.C., last month. It got a push from the Supreme Court's decision last summer to overturn Chevron, which had deferred to regulatory agencies when challenged in court. Right after that decision, the ABA filed a lawsuit against the Fed and its stress test that criticized the transparency of the stress test scenarios.

Chair Powell said this month that he thought the official role of Vice-Chair of Supervision, created under the Dodd-Frank Act, led to volatility in bank supervision. The key, as he told members of the House Banking Committee this month, is that regulations remain consistent regardless of who is in the White House,

“We want to have a good set of regulation that doesn’t swing back and forth very much.”

But with or without the title of Vice-Chair of Bank Supervision, Fed Governor Michelle Bowman has become the champion for transparency in bank rulemaking and in all the operational facets of bank examinations where bank managers complain all the time that guidance is inconsistent, conflicting with other regulatory agency guidance, or just difficult to understand. In her view, bank supervisors need to do a better job; they must be more transparent about the rules and what bank management expects to comply with.

As she said this month to a group of community bankers,

“I think there is room to improve the transparency of regulatory communication. Banks should not be left to guess what regulators think about the permissibility of…activities, or what parameters and rules should apply to those activities. Uncertainty discourages investments in innovation and the expansion of banking activities, products, and services…Banks already must confront the challenges of dealing with evolving economic and credit conditions, regulators should not compound these challenges through opaque expectations and standards.”

Yes, she is correct. Opacity and inconsistency are counterproductive. Then again, there is the transparency paradox, where the more there is to see, the less you can see. Thus, details are less visible from a higher vantage point, but trends become more so. And sometimes, the public would be better off not knowing the truth. The truth is that bank supervisors, even within their agencies, do not always know, much less agree, what activity or banking product should fall in or out of the scope of this rule or that one or be in or out of a standard, and how that standard should evolve as the markets and economy change. The Fed may need to lead, but this does not mean it knows where it is going because this time is different, and nothing is familiar.

Nothing Changes Despite Change

But maybe the Fed has no idea where it is going regarding the economy or how to prevent the next systemic financial crisis because everything it has done does not seem to matter. It is still not going anywhere. The economic picture is still great, and nothing has changed. On a real basis, for example, the Fed raised rates by 10 points, from minus 8% when CPI was at 8% in March 2022, and nominal rates were at 0% to plus 2% in July 2023 after its last hike brought Fed funds to over 5.25% when inflation just got under 3%.

A 10-point change in real interest rates over 16 months should be enough to knock over any economy, but the US economy kept chugging along. Thankfully, unemployment stayed low, but inflation readings remained and continue to remain stubbornly high. Rate hikes did not tank the economy, and so far, for all the bluster, executive orders, and tariff talk coming out of Washington, the consumer is still spending, even if bird flu infects the food chain and the price for a carton of eggs is soaring. They could be cutting back spending at retail outlets but instead shelling out more at restaurants, but the consumer driving the economy is still spending.

Then, the Fed cut rates by 100 basis points last quarter for reasons that still seem hard to fathom, although, for some reason, the Fed was worried that short-term rates would be too high and could damage the economy. Also, the ECB and the BOE were cutting rates, and there is something to like about central bank coordination. However, if rate hikes did not end up reining in inflation, rate cuts have not stoked inflation, either. At least not yet. Price change remains higher than the Fed wants but not high enough to cause it yet to turn around and raise rates again. At least, that is what bank treasurers who talk to our editors say they think.

You can plus this and minus that, but the data feed on the economy tells everyone as plain as day that nothing has changed. That is transparently obvious. Rates were higher, and now they are a little lower on the front end, but nothing much has changed. There are more layoffs beyond just federal workers, but there are still more jobs than employable people can do. The more things change, the more they stay the same.

It is fair to say that what the Fed does on rates does not even matter to borrowers, who will borrow or not, irrespective of the current lending rate when they need to borrow. As the chairman and CEO of a regional bank on the west coast told analysts,

“I think, if there's not going to be another rate cut…that probably will have a negative impact for commercial real estate and curb investment opportunity, which indirectly would affect commercial and industrial business growth. And that would not be positive. But, on the other hand,…even though rates are not dropping much, the market takes it positively because people feel that, hey, as long as the economy is going to grow substantially stronger, as long as businesses are going to get higher revenue growth, they are totally okay with a high interest rate to pay more interest expense because the revenues grow even at a higher pace. That's all that matters, right? That's how people feel.”

In other words, the Fed can cut rates or raise rates, and borrowers are going to still do what they want to do. Bank supervision is another example where do something or nothing does not change the overall result. Supervision's goal should be to ensure the banking industry is resilient enough to weather the common cold, a typical business cycle. If it gets sicker than that, if the economy turns into the Great Recession, for example, another goal should be that that the industry have the proper insurance and get regular check-ups so that when things go bad, bank supervisors can catch the problems quicker and maybe head them off from becoming catastrophes.

Nevertheless, for all precautions taken, from Basel 1, 2, 3, and beyond, to the Dodd-Frank Act stress tests, to the liquidity buffers and push for clearing, financial crises still seem to come out of the blue and take everyone by surprise. The Global Financial Crisis exposed a capital hole in the largest banks lying in plain sight if bank supervisors had been looking in the right place. When the repo market blew up on September 15 and 16, 2019, it was a surprise that the Fed could have seen coming, given it controls the payment system, sees the flow, and can anticipate large payments that periodically go through it. The regional bank crisis in March 2023 was a surprise, especially given that Silicon Valley Bank (SVB), Signature, and First Republic were all rated satisfactory or strong by their bank supervisors at their last exam. The vulnerabilities that caused SVB to fail were well-known to its examiners.

Zeno's Paradox: You Never Get Anywhere

Zeno would say that you never really go anywhere and that moving from point A to point B is just an illusion. Thus, the Fed's monetary policy and efforts at bank supervision are a waste of time. The policy is still going to be ineffective. Supervision will still fail to prevent surprise and catastrophe from lurking at every turn.

Practically speaking, for bank treasurers, restructuring one's legacy fixed-rate MBS portfolio just to trade into a current coupon bond and improve the current yield on earning assets is a waste of time. The book yield on the average bank's MBS portfolio in Q4 2024 was 2.6%, nearly 2 points below its marginal cost of funding, where the effective Fed funds rate is 4.3%. As the portfolio's legacy assets run off, that book yield will creep higher. Still, judging how the Fed's $2.2 trillion SOMA portfolio of MBS has been throwing off about $15 billion to $17 billion in amortization cash flow per month, it will be a few years before the book yield for the average bank's MBS bond portfolio gets anywhere close to its cost of funding.

Restructuring the portfolio as a trade makes a nice commission for the broker but does very little to change the challenging condition of the balance sheet. For example, using numbers for all commercial banks at the end of Q4 2024, the book value of the AFS portfolio equaled $3.5 trillion compared to $3.3 trillion on a fair value basis. Even if it restructured its AFS portfolio and with $2 trillion in capital was able to absorb the hit, the industry still has a lot of other fixed-rate assets on its balance sheet, which it cannot do much about, even if it could restructure everything on its balance sheet.

Its $2.3 trillion HTM portfolio is $299 billion underwater. The industry is also sitting on a $5.5 trillion real estate loan portfolio, according to current Fed H.8 data that grew by $1.0 trillion since the onset of Covid five years ago. Thus, originating new loans over the last couple of years were accretive to NIMs and NIIs. Unfortunately, most of the industry's real estate loans were originated when mortgage rates were at historic lows. Public disclosures are unnecessary to appreciate that the loan book, if sold, would require a significant market concession.

Then, there is the math problem. If a bank treasurer wanted to sell the entire AFS book today as SVB did two years ago and realize a $184 billion fair value loss on $3.5 trillion bonds, the par value of the new bonds would equal $3.3 trillion. Usually, the sale and earn-back trade as brokers pitch it takes three years to recoup the fair value loss realized on Day 1. However, doing it still leaves you unprotected should the Fed turn around and raise rates. To add insult to injury, the bonds sold with a book yield of 2.6% will probably sell to at a current yield of 7%, precisely the same current yield for the bonds purchased to replace them. The bonds might change, but as Zeno would appreciate, the yield remains the same.

Zeno's Bank Treasury Philosophy: Stay Neutral

Because Zeno would not have only rejected the sale and earn-back trade, he would have dismissed all value trades and not have cared about rich/cheap comparisons. Buying low and selling high, according to Zeno's philosophy, does not improve long-term returns. Zeno, just like bank treasurers, was all about buy and hold. Bank treasurers are "buy and hold" even if they are forced under the accounting rules to value bonds at fair value because they are not trying to profit from market moves.

They are just trying to manage the asset-liability dynamics on their balance sheets as efficiently and as shareholder value-added as possible. Selling a bond in the portfolio that is currently underperforming and replacing it with one that offers a yield pick-up for the same bond price will do little, if anything, for the portfolio's long-term performance, even if it helps short-term.

If he had managed a bank's investment portfolio, he would have taken a holistic view of it as part of his balance sheet’s ecosystem, considering it within broader asset-liability and liquidity management objectives than just whether this or that bond in the broker's trading inventory was rich or cheap to the 10-year. Long-term focused, he would also have been neutral to short-term interest rates. If going from point A to point B is pointless because all distances and differences are an illusion, why would he want to allow noise from short-term rates to impact his long-term investment strategy and asset-liability management objectives?

As the CFO of a regional bank in the southeast told analysts what he thought about the prospect of cuts or hikes this year and what it would do to his earnings,

“Overall, we are neutral to the front of the curve…Our intent…with our hedging program…to maintain neutrality.”

The CFO from another larger regional bank in the southeast described his hedging strategy to protect for rates up and down as a long-term strategy using derivatives,

“We did add some pay-fixed swaps to manage the risk that long-end rates might go higher and AOCI could create capital risk. And…we continued to manage the risk of a much lower short-end and are adding some received fixed swaps, as well. And…we are…thinking about that protection not just in '25, but in '26 and '27 and beyond.”

Just for the record, this is a good place to remind our readers that Eris SOFR Swap Futures contracts, an invention by one of this newsletter's corporate sponsors, can be used the same way as the above-quoted CFO described, except with lower margin costs and more transparent pricing. Eris Futures contracts trade on the CME, and bank treasurers can use them to hedge without going through a costly and lengthy ISDA process. Futures commission merchants, such as RJO Brien, another of the newsletter's corporate sponsors, can have your bank up and trading in a matter of days after opening an account.

Dinner Rolls and Infinity

Here is a good way to understand what Zeno was talking about:

Let's say you go out for dinner with your broker. You are going to a steakhouse, because why not? The broker orders wine and the server brings over the bread basket. For some crazy reason, the server only brings one dinner roll to share with you. Your broker offers the roll to you to eat, but as you reach for it, you remember that your compliance department has been all over you about accepting broker gifts. So, you decide to share the roll with your broker and break it in half to split it between you.

Now, your broker, who so much wants to get a trade done with you and always seems to lose to you when you play golf, takes half of the roll you offered and splits it into two pieces, handing back one of them to you in a grand gesture claiming dietary restrictions of some sort and encouraging you to end the madness there and just eat the roll. But you do not, and neither does your broker. From then on, until dessert, you and the broker just keep breaking the infinite halves of the roll in two and passing half back between you, over and over, endlessly dividing, subdividing, and subdividing on and on until infinity, or until the server brushes the infinitely divided crumb off the table before serving coffee.

Basically, you and your broker ate that roll, but technically speaking, neither of you ever finished it, theoretically locked in a passing game involving smaller and smaller halves of the roll to infinity or until the check comes, whichever comes sooner. That was Zeno's point: if the world can be infinitely subdivided, you can never get anywhere. As Zeno said, the world cannot be divided, nor can the bread roll be broken in two. When given the roll, you told your broker thank you, put some butter on it, and ate it. Or it just does not matter because breaking bread with your broker is all about relationships, so no one ate the roll.

Calculus Solves Zeno's Paradox

Nothing is as it seems. It does look like you can divide the roll and share it with the broker, but it really cannot be divided. In truth, neither of you ate the roll because the entire roll, including that last errant crumb, was not entirely consumed. Which certainly seemed paradoxical to Zeno and continued for centuries. That is, until Sir Isaac Newton and Gottfried Wilhelm Leibniz came along in the 17th century and invented calculus, finding that using their sum of the integrals approach and focusing on differentials, they did not need that missing crumb of the roll to finish eating it. You can get 99.9% of the way there, and no crumb will stand between you and the finish line.

It is a good thing those guys came along, too. With his infinite demands, Zeno presumably might have disapproved of generally accepted accounting principles (GAAP) related to the definition of the term "highly effective" for hedge accounting. Under GAAP, being highly effective does not mean being perfect. It means that the change in the hedging instrument's fair value changes within 80% to 125% of the hedged item change. Even that standard is sometimes challenging for hedging programs to meet, given that the risks bank treasurers are trying to manage come with their own wild and unpredictable tail risks.

Limits to Regulatory Relief

We only bring up Newton and Leibniz to observe that your bank examiner, who either is in or has recently been in your bank treasury offices, has never heard of them, at least not in the context of your bank's exam review. They will generally not be satisfied with performance that is mainly for all intents and purposes there but is still missing key deliverables. The checklist and the process for filing a de novo application is a case in point, as Governor Bowman noted this month,

“Today, the process to obtain regulatory approval can be influenced by many factors under a bank's control—for example, the completeness of the application filed and responsiveness to addressing questions and providing necessary additional information. However, the timeline for application decisions is often uncertain and beyond the bank's control.”

According to sources of the newsletter, if your bank’s balance sheet assets is below $10 billion, exams are going a little easier, but mostly this is in tone not substance. Banks still need to check all the boxes on the first day letter. For larger banks, bank treasurers are looking for more than just a change in tone. As the chairman and CEO of a regional bank on the west coast told analysts this month, all he wants is that regulations are less burdensome,

“Less, regulatory burden is always helpful because then we don't have to spend that much time submitting reports here and reports there.”

The chairman, president, and CEO of a regional bank in the southeast agreed,

“What I can say is that if we have less examinations, less oversight, that it will create more capacity for our teams. Our credit teams spend a lot of time with our regulators going through files, things like that. So, if there's one thing we know in life, you can't create more time, but if you have less regulatory administrative burden, then our team members will have time to be able hopefully to deploy to more revenue generation.”

The CFO from a GSIB wants rules and understands why they are important, but wants rules that are coherent,

“We've been clear about what we think is important…we want balanced coherent regulation that is not inflexibly anti-bank and that allows banks to support the economy and growth in the economy without conflicting with the safety and soundness of the system. And things should be evaluated holistically.”

Regardless of a change in tone or fewer reports, your examiner wants two things from your bank during the exam. The examiner wants a checklist and a process. The process is not about getting something done and finished. It is about constantly improving, as the senior executive at a regional bank in the southeast said,

“We're continuing to improve our risk management practices as we become larger and more complex, and it's not about getting to $100 billion. It's just about getting better every day.”

The checklist is in the first-day letter. It makes up the deliverables during the exam. Every report that belongs in the file, every single crumb, even if it does not matter anymore because the report concerns legacy assets set to mature this quarter anyway, must be in the file. However, the process is how the bank treasury executes liquidity planning and manages interest rate risk. A bank can constantly improve on the process, but there are no finish lines, just an infinite stream of future updates of 2.0s, 3.0s, and so on.

Loan Growth Just Around an Infinite Corner

Zeno said you never get anywhere because every step involves an infinite series of mid-steps you cannot get through in a finite period. The way bank managers have tried to explain the delay to see a rebound in loan growth sounds like Zeno’s paradox: always just about to get there, but not just yet. Last summer, for example, borrowers were sitting on the sidelines because of the economic uncertainty and timing of rate cuts. Prospective borrowers wanted these issues resolved before they would be ready to sign for credit.

Then, when the economy looked like it was not falling over anytime soon and the Fed began cutting rates, loan growth was still neutral, but then the explanation was that borrowers needed to get the election out of the way. After the election, the next issue was tariffs and overall uncertainty about the Fed. And there is always going to be another reason not to borrow. As the chairman, president, and CEO of a regional bank in the southeast said,

“I think there's enough certainty…So obviously there are going to be people sitting on the sidelines saying there's uncertainty. Maybe I'll wait. But I think we're seeing enough animal spirits that people are starting to lean in as well. When I talk to our teams, we're presenting more term sheets than we have in the last several quarters.”

Loan growth still does not show much of a pulse, judging by the latest H.8 data (Figure 1). But that does not worry bank management because their borrowers are optimistic, as the CFO of one of the GSIBs assured analysts at an industry conference this month,

“We are in a slightly more enthusiastic moment, I guess, generally in the business world. And so, you might see loan growth.”

In the latest Senior Loan Officer Opinion Survey, the Fed suggested that demand by large corporates for loans was up a little bit, but there is nothing to show for it in the H.8 data where funded loan growth remains nonexistent. Borrowers are still not precisely on the page to draw down on their committed lines, as the CFO of a large regional bank based on the East Coast reported,

“What you see and what you read about is bullish for us. We thought we'd see some pickup in loan growth because of the election, which we haven't seen yet. Possibly some of that delay is these tariffs and the uncertainty. But we're constructive, and we think we'll see the growth.”

Figure 1: C&I Annual % Loan Growth

And, logically, loan growth should pick up because the industry has grown all these committed lines. Why would borrowers pay for lines that they would not use, the CFO argued,

“I think probably the best indication of loan growth coming sooner rather than later is that we are growing committed lines…companies are establishing lines of credit that they pay for that they haven't drawn on. So that's probably the best indication of intensive borrow because you wouldn't obviously pay for something you have no intention of borrowing. I think it's going to be one of those things that when it gets going, it will get going.”

But so far, for all the promising signs, there is not much to see in the loan growth numbers. The CFO of a large regional bank based in the Midwest said that shareholders need to remain patient, take consolation in the positive market sentiment, and hope,

“Market sentiment is improving. There's a lot of enthusiasm…from our clients. We…see modest improvement in pipelines, and we're hopeful that that translates into loan growth, particularly in the second half of the year.”

The fatal flaw in Zeno’s thinking about the world is that you and your broker have all the time to finish the dinner roll. The reality is that your waiter does not have all day for you to pass it back and forth, and neither do your shareholders, to wait for the legacy bond portfolio to run off or for loan growth finally to pick up. They want it now, ready or not. But if they need to wait, at least when they go to dinner, they should get a full breadbasket.

The Bank Treasury Newsletter is an independent publication that welcomes comments, suggestions, and constructive criticisms from our readers in lieu of payment. Please refer this letter to members of your staff or your peers who would benefit from receiving it, and if you haven’t yet, subscribe here.

Copyright 2025, The Bank Treasury Newsletter, All Rights Reserved.

Ethan M. Heisler, CFA

Editor-in-Chief

This Month’s Chart Deck

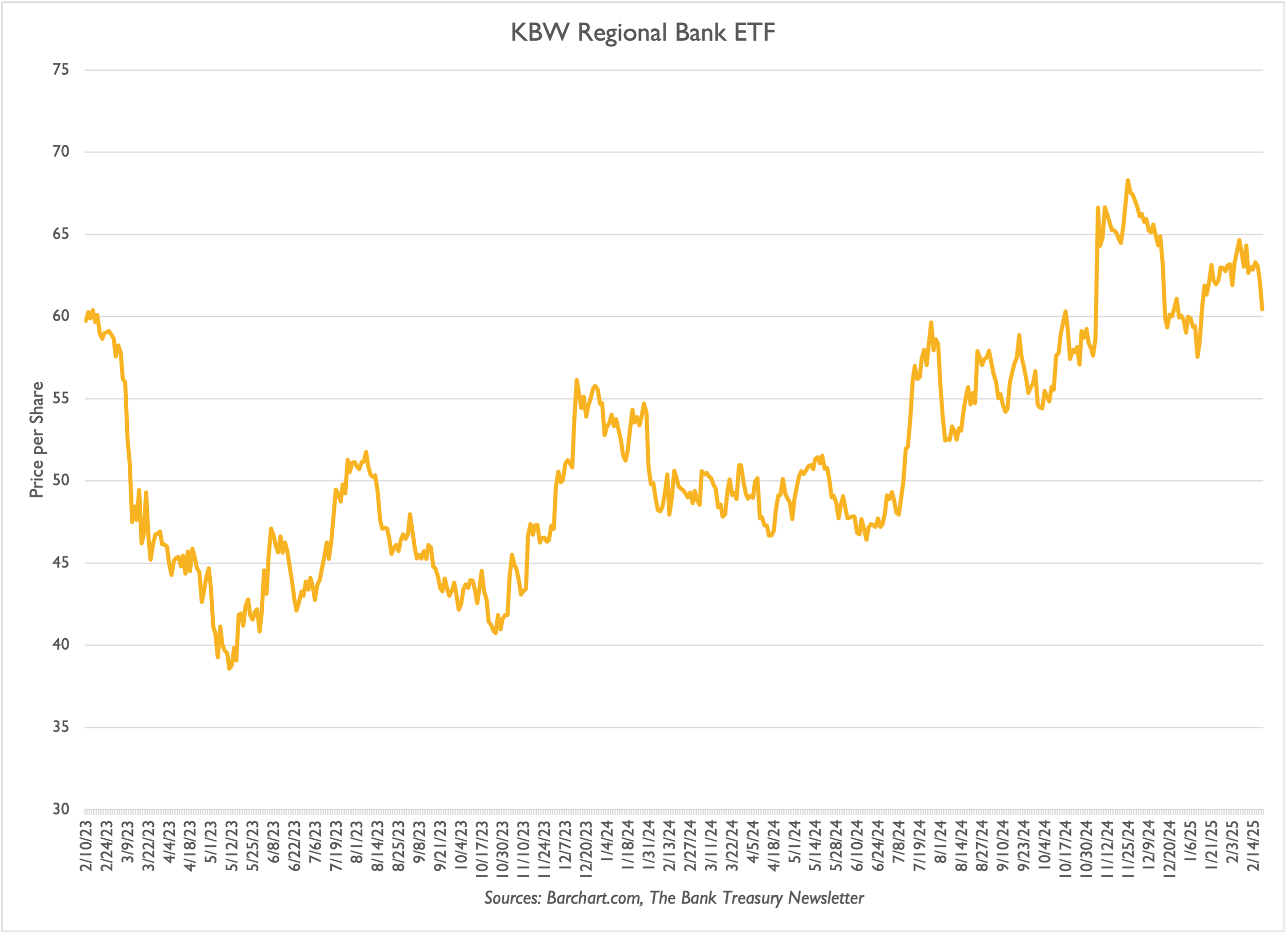

Regional bank stocks put the regional crisis two years ago next month behind them, reaching and holding onto gains in the first month of 2025 (Slide 1) despite uncertainty about the path of Fed rate cuts in 2025, a flat yield curve, and broad macro-economic and geopolitical risks threatening the economy’s heretofore smooth economic path. In addition, the banking industry’s capital strength remains impaired because of the unrealized losses in its fixed-rate assets, which worsened despite the Fed’s three rate cuts totaling 100 basis points last quarter. Unrealized losses in its investment portfolio slid (Slide 2) to 16% of Common-Equity Tier 1 capital (Slide 3).

Leaving aside the drag on its net interest margin (NIM) from its underwater bond portfolio, the banking industry is holding over $5.5 trillion in book value real estate loans, which barely ekes out a spread over its marginal cost of funds but is still doing better on paper compared to the negative book yield spread it is incurring on its mortgage-backed securities (MBS) (Slide 4). NIMs are back equal to where they were in March 2023 (Slide 5). Still, of the 350 basis points of NIM it reported on average in Q4 2024, banks earned a near-record high 74 basis points from holding a higher ratio of interest-earning assets to interest-bearing liabilities than it did a decade ago and from achieving a higher rate on net free funding. (Slide 6).

The book value of interest-bearing deposit cost to the EFFR stabilized over the last year, another sign that the effect of the regional crisis and the Fed’s rate hikes between 2022 and 2023 has dissipated as a factor dragging on funding expense (Slide 7). However, banks continue to increase their funding from reciprocal deposits (Slide 8) and, so far, continue to sit on FHLB advances (Slide 9).

Although the outlook for the redraft of the Basel 3 Endgame appears uncertain, as initially drafted, the proposal would have raised regulatory capital requirements on banks with total assets over $100 billion, which on average at year-end 2024 reported Common Equity Tier 1 Capital equal to 21% of risk-weighted assets (Slide 10).

Regional Bank Stocks Are Holding Up

Bond Portfolio Unrealized Losses Climb

Capital Impaired By Unrealized Bond Losses

Mortgage Exposure Dragging On NIM

NIM Leveling Off

Net Free Funding Gives NIM Huge Assist

Deposit Beta Sensitivity Stabilized

Use of Reciprocal Deposits Still Climbing Post SVB

Banks Are Holding Back Paying Down Advances

Do The Largest Banks Really Need More Capital?