Banking from the Bank Treasurer's Perspective

Professional Insights and Commentary on Bank Treasury Issues, Investment Portfolio Strategy, and More.

Latest Newsletters

The Fed’s conduct of monetary policy has been very wanting lately, given that its rate cuts last fall caused the 10-year Treasury to sell off and made bank treasurers wonder whether the Fed has a handle on interest rates or the economy. Even though bank treasurers appreciate a normal sloped yield curve, this was the first time in 40 years when the Fed’s rate cuts caused the yield curve to bear steepen. Not only are treasurers saddled with negative AOCI, but they are also earning 100 basis points less on their cash pile at the Fed.

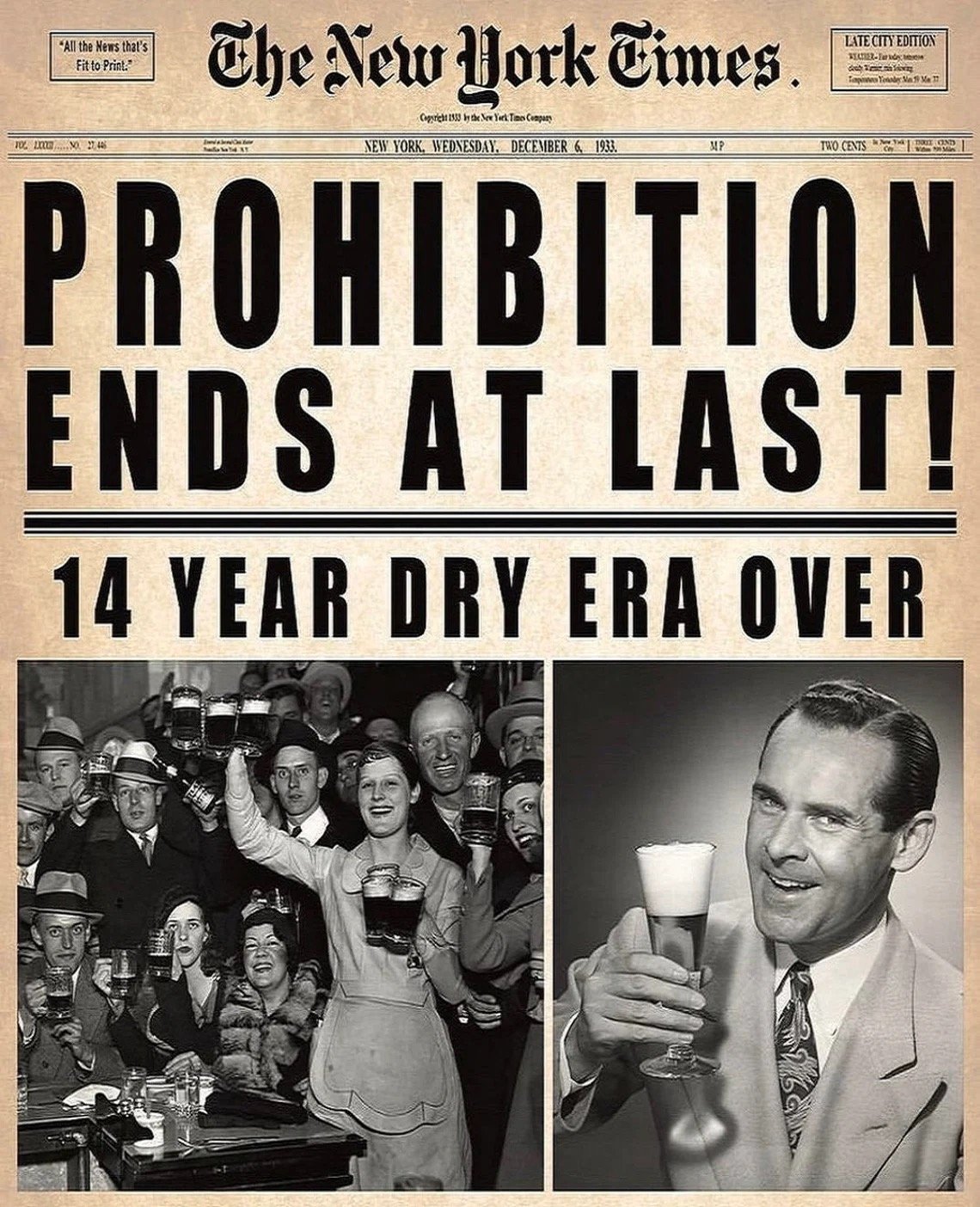

People celebrated the end of Prohibition 91 years ago this month. But while they were partying in the streets, Congress was busy passing a new kind of prohibition on the banking industry against reckless behavior that endangered the financial system's stability and the economy. Since Glass-Steagall, lawmakers and rule makers have gone back and forth at once, easing and then tightening regulations responding to alternating demands by the public that rules and regulations were either stifling or ruining the economy.

Bank treasurers have more in common with the Mayflower Pilgrims than they might first think. Like the Pilgrims, they are surrounded and outnumbered by loan and deposit officers, bank customers, examiners, and shareholders. Armed with muskets that left a deep impression on the native tribes, the Pilgrims ultimately survived through diplomacy. Bank treasurers may not go to work armed with muskets, but like the Pilgrims, they need buy-in with all parties, internal and external, critical to delivering stable NIMs and growing NIIs.

This month is the 20th-anniversary issue of the newsletter. In this edition, we look back at some of the major stories we have covered in the world of bank treasury. From rate cycles to accounting issues, Basel capital, AOCI, mark-to-market, and hedging, we delved into bank treasury investment strategies, trends in deposit balances and betas, and cost of funding. We covered the transition from LIBOR to SOFR and from incurred loss to CECL accounting. Over 20 years, bank treasurers have seen it all, from the GFC to the regional bank crisis last year, from the repo panic in September 2019 to the mini panic over the recent month-end. We have been there when the yield curve was positively sloped and inverted. This is where bank treasurers go to read all about it.

The forwards might already have priced in the 50-basis point cut this month, but for many bank treasurers, the move by the FOMC this month was a surprise and a bit unsettling, worried that the voting members might see something terrible on the horizon that they do not see.

A worse-than-expected nonfarm payrolls (NFP) print at the beginning of this month set off a short-lived market panic in the equity and bond markets that continued into the following week.

The banking industry reported another solid quarter of earnings, which met and, in some respects, exceeded analyst estimates. Storm clouds on the horizon remain muted.

This month’s newsletter covers speculation on the timing of the first rate cut, the positives and negatives of an inverted yield curve and higher for longer, the effect of QT on reserves and bank deposits now that the balance of the RRP appears to have hit a floor, and why rate cuts will not necessarily lead to lower deposit rates.

This month's newsletter is dedicated to the memory of Gerry Corrigan, the sixth president of the New York Fed from 1985 to 1993, known as the Fed's plumber, the go-to guy Paul Volcker and Alan Greenspan turned to in a financial crisis. He would have made a great bank treasurer, not only because of his training as an economist but because he understood the mechanics of an economic system and how to fix problems when they arose, a valued skillset for bank treasurers.

BTN Podcast Featured Episodes

How is artificial intelligence changing the banking industry? Will bank analysts be replaced by A.I.? And is that a bad thing? A former Credit Suisse analyst and a veteran European bank expert weigh in.

Ethan talks to privacy experts about the value of personal information and what banks need to do to protect their employee and customer data given escalating risks in the cyber-security space.

Sam Theodore, a veteran European bank analyst, reflects on what to expect from the unexpected both in the US and in the Eurozone.

In this age of heightened uncertainty, bank treasurers are reviewing and updating their ALM toolkits. Join me for a conversation with Michael Riddle and Geoffrey Sharp to find out how ERIS SOFR Swap Futures offers users the sophistication of an interest rate swap with the simplicity of a futures contract.

Join me for a discussion with Moorad Choudhry, Author of The Principles of Banking, on his takeaways from the failure of Silicon Valley Bank, Signature, and First Republic, and what he has learned from his study of U.K. banking that bank treasurers in the States should consider as they seek to shore up their interest rate and liquidity risk management.

The Bank Treasury Newsletter is an independent, free publication made possible by the generosity of our sponsors.

Interested in becoming a sponsor? Let’s talk.

Zeno was a Greek philosopher who lived 2,500 years ago and argued that no matter how far one goes in any one direction, no one gets anywhere. Distances and speed are an illusion as he views the world. If alive today to advise bank treasurers, he would advocate long-term buy-and-hold strategies. Likely, Zeno would have been no fan of short-term, relative value trade ideas and legacy asset restructuring proposals, believing they did not create shareholder value. His advice would be, as difficult as it is for bank treasurers, given the significant unrealized losses on their balance sheets, to sit with low-yielding assets below their marginal cost of funds and let them run off rather than pursue short-term fixes that still leave them no better off in the long run.